This past Friday eMarketer put out a note with the subtitle, “As time spent with digital radio rises, ad loads, rates follow.” The conclusion was drawn from data in the recent Internet Radio & Streaming Report by XAPPmedia/RAIN News along with Edison and eMarketer research. While it was nice to see XAPPmedia data cited by eMarketer, there were two conclusions by their analysts that were particularly important for the industry:

- There is an imbalance between time spent with Internet radio and the percentage of ad dollars devoted to the media.

- “In order to avoid interrupting too much listening time and still drive revenues, services will likely raise the cost to advertise.”

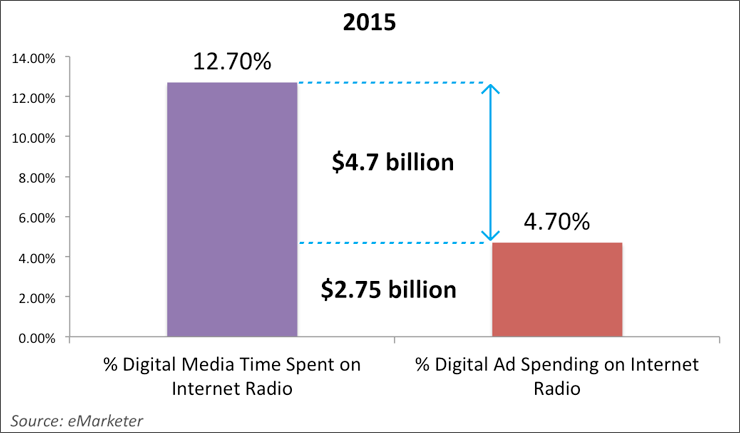

The Time Spent to Ad Dollar Spending Gap

“eMarketer forecasts that digital [Internet] radio will account for 12.7% of US adults’ daily time spent with media in 2015, at 43 minutes on average—compared with 11.1% share and just over 30 minutes two years ago.” This contrasts sharply with the expected 4.7% of 2015 U.S. ad spending directed to Internet radio totaling $2.75 billion. That represents an 8% gap in potential spending based on time spent with media. When considering total expected digital ad spending in the U.S. of $58.6 billion in 2015, that gap looks more like a gaping $4.7 billion hole.

Mary Meeker of venture firm KPCB has famously chronicled for years the gap in time spent on mobile media compared to advertising spend shifting to the channel. We know that Internet radio is now a predominantly mobile medium and its time-spent-to-ad-spending gap is paralleling that earlier pattern. The key takeaway here is the tremendous upside for ad-supported Internet radio revenue.

Ad Revenue Growth to Come from Higher Ad Rates

eMarketer has also picked up on another industry phenomenon. Internet radio services cannot simply increase ad load in order to drive revenue. While Internet radio ad load currently sits at about 25% of broadcast radio, consumer expectations are fundamentally different. Internet radio doesn’t enjoy the regulatory protections of broadcast radio stations in a given geographic region. The competition for any format on Internet radio is global and unlimited.

eMarketer has also picked up on another industry phenomenon. Internet radio services cannot simply increase ad load in order to drive revenue. While Internet radio ad load currently sits at about 25% of broadcast radio, consumer expectations are fundamentally different. Internet radio doesn’t enjoy the regulatory protections of broadcast radio stations in a given geographic region. The competition for any format on Internet radio is global and unlimited.

Internet radio services have stated publicly and privately that data suggests keeping the ad load under three minutes is optimal for user experience and retention. Considering that the top priority cited by industry insiders in the Internet Radio & Streaming Report was audience growth, you can see why improving ad rates is more favored than raising ad load.

Data Shows Internet Radio’s Advertising Future

According to eMarketer, Internet radio time spent listening has grown 43% in just two years. Internet radio ad spending is growing at an even faster rate, but there is still a large gap between time spent with media and ad revenue. The key to closing that gap will be increasing ad rates. To do that, Internet radio will need to introduce innovative ad formats that can drive higher advertiser ROI.

Consumers have flocked to the high quality mobile media experience provided by Internet radio. Advertisers are now heading in the same direction.

Related Posts

Industry Insiders Speak Out – New eBook on Survey Results

New Data: Consumers Prefer Ad-Supported Listening

Internet Radio’s Ad-Supported Present and Future