I am a music fan. I both purchased vinyl albums as gifts last year and received a few. I think it’s great that vinyl records are making a comeback and I can share the experience of that format with my daughter – and now when I say “record album” a good number of people born after 1980 know what I mean. It is also good that this is providing a new or renewed revenue source for artists and grew 32% last year. However, RIAA leadership is once again mis-reading the organization’s own data to suggest that vinyl is a better revenue generator than ad-supported streaming. Vinyl actually accounts for about one-third the level of ad-supported streaming and about one-sixth of streaming revenue overall.

I am a music fan. I both purchased vinyl albums as gifts last year and received a few. I think it’s great that vinyl records are making a comeback and I can share the experience of that format with my daughter – and now when I say “record album” a good number of people born after 1980 know what I mean. It is also good that this is providing a new or renewed revenue source for artists and grew 32% last year. However, RIAA leadership is once again mis-reading the organization’s own data to suggest that vinyl is a better revenue generator than ad-supported streaming. Vinyl actually accounts for about one-third the level of ad-supported streaming and about one-sixth of streaming revenue overall.

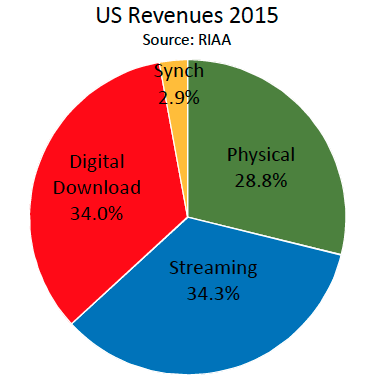

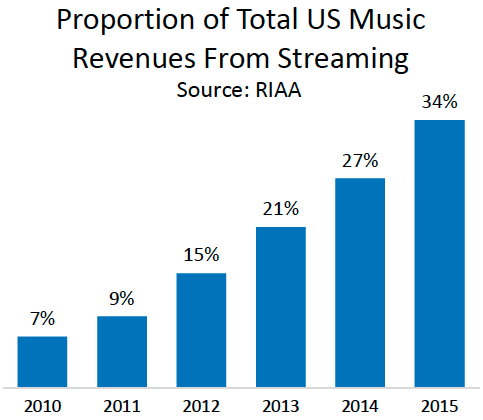

The big money for music rights holders today is in digital. RIAA data suggests that 70% of industry revenue in 2015 was from digital with 30% coming from physical sales. Why the RIAA ignores synchronization fees in this calculation is unclear. They represent 3% of total sales and at $203 million seem relevant. Regardless, even at 68% of revenue means digital is important. Of the total industry revenue, streaming music made up the single biggest category at 34.3% and $2.4 billion. RIAA concludes that reflected a 29% rise over 2014. Vinyl albums also had a good year growing 32% to $416 million. The other half of digital comes from downloaded music. It didn’t do as well, recording a 9.8% decline.

Overall, industry revenue rose about 1% driven largely by streaming, both subscription and on-demand. In fact, streaming grew quickly enough to more than offset 10-11% declines in both the digital download and physical sales segments. All industries want to grow fast, but it is fair to say that music is a mature industry. The source of revenue is changing quickly as consumers adopt streaming, but the industry overall is flat. Last year, the IFPI reported a similar situation on a global music sales that were 0.4% less than the previous year. Supply and demand appear to be in balance.

Using Vinyl as a Rhetorical Club

It is perplexing how the RIAA CEO made the same mistake two years in a row interpreting these results. Willful ignorance or an intentional spin from a long-time lobbyist with an agenda? You make the call. In a Medium post, he claims that Vinyl brought in more industry revenue than ad-supported streaming services. This is factually incorrect.

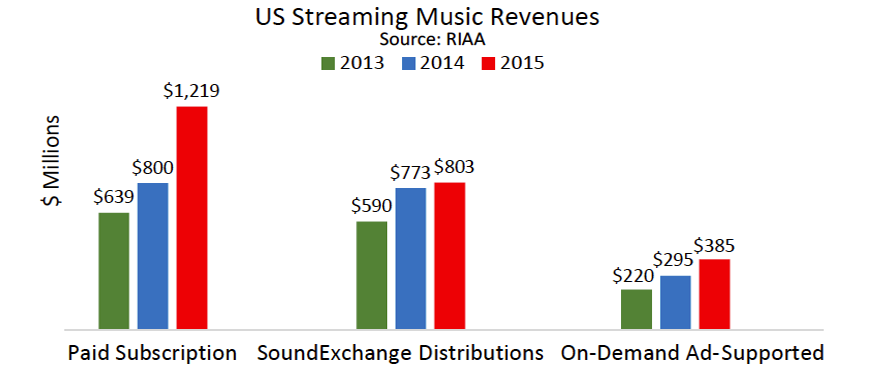

RIAA breaks down streaming into three categories. Paid Subscription revenue is from streaming services that distribute a percentage of their subscription revenue to music rights holders through directly negotiated agreements. SoundExchange Distributions represent revenue that streaming services paid to music rights holders based on a government rate structure for each song play. The more song plays, the more revenue for the rights holders. The audio publishers that utilize this agreement derive their revenue almost entirely from advertising. The final category is On-Demand Ad-Supported. This category generates revenue from advertising and pays music rights holders a negotiated percentage of all revenue (often 70% or more) similar to subscription agreements.

Based on the definitions above, it is clear that one revenue category is from consumer subscriptions and two generate income through advertising. The ad-supported revenue categories generated $1.2 billion in 2015 for music rights holders. This is nearly three times more than the $416 million from vinyl sales. And yet, the Medium article ignores $800 million in ad-supported SoundExchange revenue suggesting that Vinyl generated more revenue than the $385 million from On-demand Ad-Supported. The implication is that advertising models don’t generate enough revenue if vinyl can out-produce them. The fact is that any category can be larger than a subset of another larger category. It is simply a matter of how you slice the data. That is what was done here.

Vinyl is a good story and streaming in all forms is good for the industry. The real challenge to industry economics came from music labels partnering with Apple iTunes to break up albums into singles. There is a direct correlation between that decision and precipitous industry revenue decline. The industry had distorted unit economics for years by forcing consumers to purchase entire albums instead of just the songs they liked. Revenue would have continued to fall if not for streaming revenue that now fills the gap, has stabilized the industry revenue base, and is helping drive modest growth again. Ad-supported listening makes up a big portion of that revenue because most consumers choose advertising over subscription. They are choosing in the digital realm the same model that music labels historically championed in broadcast radio.

The Problem with Middle-Men

The RIAA is not in the business of supporting artists. It is in the business of protecting and maximizing the financial interests of music labels. Sometimes those interests align with artists and sometimes not. RIAA represents the middle-men of the industry. The music labels are not the creators. They are the capitalists buying up the intellectual property created by artists at low prices and then trying to maximize their profits.

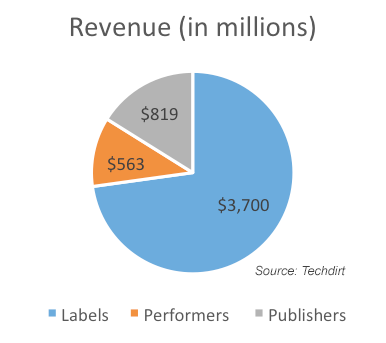

However, in most industries middle-men only take a few percent on the transaction. The majority of the revenue goes to the creators and distributors because they are at the source of production and consumption, respectively. By contrast, most of the revenue in the music industry goes to the middle-men. The music labels retain about 73% of payouts to rights holders while performing artists get just 11% according to a 2015 Techdirt analysis. Music is an industry where the middle-men don’t create anything and they don’t serve the customers directly, but they still command the vast majority of income.

In 2014 at the Web Summit conference, Bono summed it up this way:

“The real enemy isn’t between digital downloads or streaming. The real enemy, the real fight… is between opacity and transparency. The music business has historically involved itself in quite a considerable deceit… the record labels haven’t been transparent.”

As the middle-men, music labels suggest the economics are out of their control. How can that be when they control the majority of industry revenue?

What’s Really Going On is Posturing

The RIAA CEO is a registered lobbyist. He was an RIAA lobbyist from a top DC law firm and lobbied for BP in the past before becoming RIAA president then CEO. He is posturing to help position his clients as sympathetic, to improve their negotiating position with streaming services and to justify his $1.6 million in annual salary reported by Digital Music News. His clients are Universal Music Group, Sony Music Entertainment and Warner Music Group. These three companies controlled 73% of music industry revenue in 2014 up from 65% the previous year and the RIAA exists to support their interests.

If you combine the market share number with the Techdirt analysis on royalty payments, you can assume that these three global companies alone retained an estimated $3.7 billion and paid out about $563 million to thousands of performing artists with another $800 million split between thousands of songwriters and a few major publishers (i.e. more middle-men). It’s good to be the middle-men when you keep almost all of the revenue.

What’s Good for Consumers and Artists

Given these economics, it’s not surprising that artists such as Perrin Lamb can make a good living by going direct to audiences through Spotify and other streaming services and not signing with a traditional music label. The artist gets to keep more of the fruits of their creation by cutting out the middle-men.

The ad-supported versions of streaming services are also good for consumers. Listeners give up some features and agree to listen to advertising, but aren’t compelled to pay a $120 annual subscription fee. It’s a lot like traditional broadcast radio, but with one key difference. Broadcast radio stations don’t pay performing artist or music label royalties in the U.S. Ad-supported streaming services do pay and deliver half of industry revenue. It’s a win-win for artists and consumers and even the middle-men typically get to take a cut.

So let’s get excited about the renewed growth of vinyl and about ad-supported streaming. Both are providing consumers the music they want in the format they prefer and are generating revenue for the industry. And if everyone wants to drive higher advertising revenue, XAPP ads typically command a 3-5x premium over traditional audio ads. That is a quick way to drive higher industry revenue on streaming music services.

[su_button style=”flat” size=”6″ background=”#D73C90″ radius=”0″ url=”/gallery/?data-filter=audio”]XAPP Ad Examples[/su_button] [su_button style=”flat” size=”6″ background=”#D73C90″ radius=”0″ url=”https://go.pardot.com/emailPreference/e/35552/300″ target=”_blank”]Subscribe to XAPP Blog[/su_button]

Related Posts

Streaming Royalties Rise, but What Story Does Soundexchange Data Tell?

Royalty Rates Rise 21%, Quest for Higher Ad Rates Begins

RIAA Misleads While Advertising Delivers 54% of Internet Radio Revenue