RAIN News reported last week on an EDMbiz presentation by Nielsen Vice President Tatiana Simonian showing further confirmation of the listener migration to online listening. It also confirmed that ad-supported listening is the dominant choice of consumers.

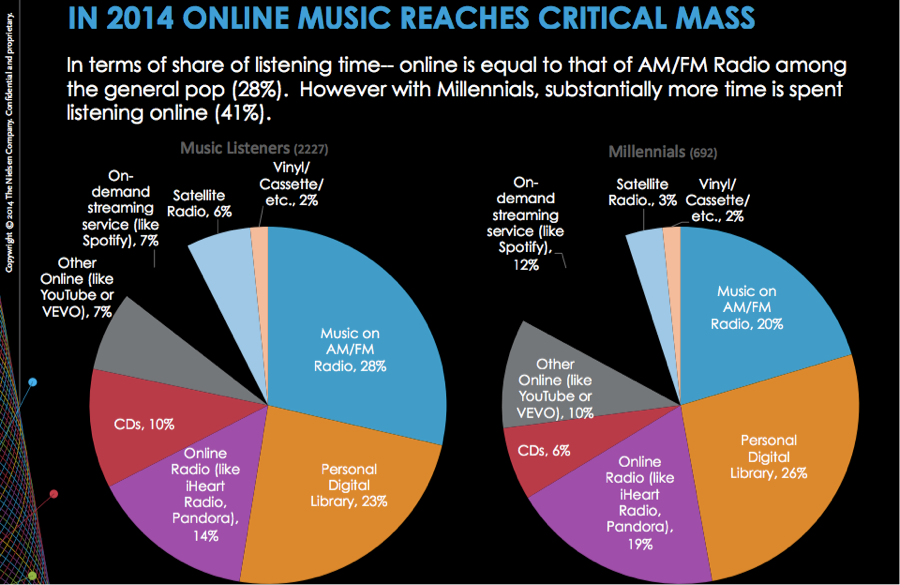

Online Listening Time Now Matches Radio, Higher for Millennials

Nielsen data from 2014 breaks out different forms of online music listening: online radio 14% (like iHeart Radio, Pandora), on-demand streaming 7% (like Spotify), and other online 7% (like YouTube, VEVO). This 28% online aggregate matches the time spent by consumers with AM/FM radio. You could argue that the 6% of listening time on Satellite radio should be added to the broadcast radio total, but you still have a clear migration of listening to online sources. Consumers have responded to the convenience, choice and personalization offered by online music services.

The trend toward online listening is even more significant when considering Millennials, which now represent the largest age cohort in the U.S. Forty-one percent of Millennial listening time is online while only 20% is on AM/FM broadcast radio and 3% on satellite. This 2:1 listening time ratio suggests a profound generational behavior shift that mirrors changes in visual media consumption. These results reflect a broader trend of data that confirms large consumer audiences have migrated to Internet radio and streaming audio services.

Consumers Choose Ad-Supported Listening

The question for advertisers is whether the migration to online listening is subscription based or ad supported. A Strategy Analytics study released earlier this year estimated that about 11% of global listeners of Internet radio and on-demand audio streaming services had chosen subscriptions. Nielsen data suggests this estimate might be too high when considering U.S. listeners.

According to the Nielsen survey, only 5% of consumers pay for streaming audio service in the U.S. It may be that Strategy Analytics found a similar pattern, but higher rates of paid streaming in countries such as Sweden where subscriptions are 15% of listeners. When we look at broadcast radio, its subscription business equivalent is 26.3 million listeners on Sirius XM. That is 10.8% of total radio listeners according the RAB and provides an example of the ratio of consumers willing to pay for subscription audio services. No matter which metric you choose, ad-supported listening will account for 89-95% of all online listening.

Media coverage of Jay-Z’s Tidal audio streaming service and the recent Apple Music launch focused on the rise of subscription listening. The data shows that the real story is migration online to ad-supported listening. Industry insiders agreed with this sentiment in a 2015 survey that revealed three times more executives citing advertising over subscription growth as a key industry trend. This is even backed up by recent high profile moves of Apple Music to include an ad-supported service and Google Play Music introducing ad-supported listening to its previously subscription-only offering.

What is Your Advertising Strategy for Online Audio?

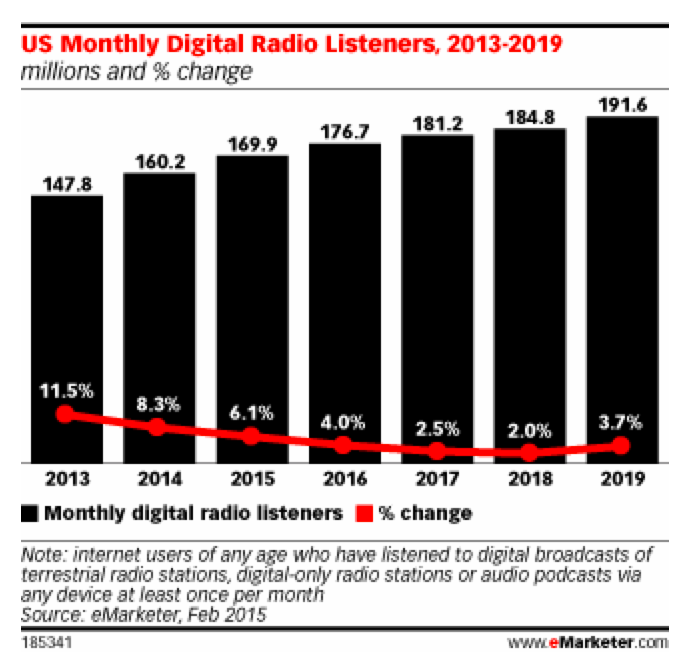

Nielsen says that 95% of online music listening is ad supported. Applying this metric to eMarketer data, it means advertisers can reach 161 million U.S. consumers through streaming and Internet radio services in 2015. That is two-thirds the total size of the broadcast radio audience but accounts for an equivalent amount of listening time. The heavier listeners and more loyal audio consumers are online.

Nielsen says that 95% of online music listening is ad supported. Applying this metric to eMarketer data, it means advertisers can reach 161 million U.S. consumers through streaming and Internet radio services in 2015. That is two-thirds the total size of the broadcast radio audience but accounts for an equivalent amount of listening time. The heavier listeners and more loyal audio consumers are online.

Don’t be surprised if online audio starts to take a more prominent role in 2015 advertising campaigns. XAPPmedia data shows the number of Internet radio advertisers climbed quickly in Q2 as marketers increase outreach to the 95%.

Related Posts

Apple is Onboard with Ad-Supported Listening After All

New Data: Consumers Prefer Ad-Supported Listening

Internet Radio’s Ad-Supported Present and Future