The Internet Radio Ad Load Report for Q1 2015 presented some interesting numbers on a declining ad load. However, the more intriguing finding was the steady growth in advertisers identified across industries. We identified a large number of advertisers in the Holiday 2014 Internet Radio Ad Load Report. As predicted in Pat Higbie’s Adotas article in December, in the first quarter of 2015 we saw that number rise substantially.

A Place Where Advertisers Want To Be

The number of advertisers jumped to 165 from 75 identified in the study during the fourth quarter of 2014. That’s a big jump. Part of it was driven by an increase in the study sample size, but not all of it. Even if you include January with the Q4 2014 numbers, you get 101 advertisers with another 64 additions in February and March for comparable samples. An inevitable conclusion is that the number of advertisers on Internet radio and music streaming services is growing quickly. That conclusion is not a surprise. Given the large audience reach of Internet radio, it has become a place that advertisers want to be.

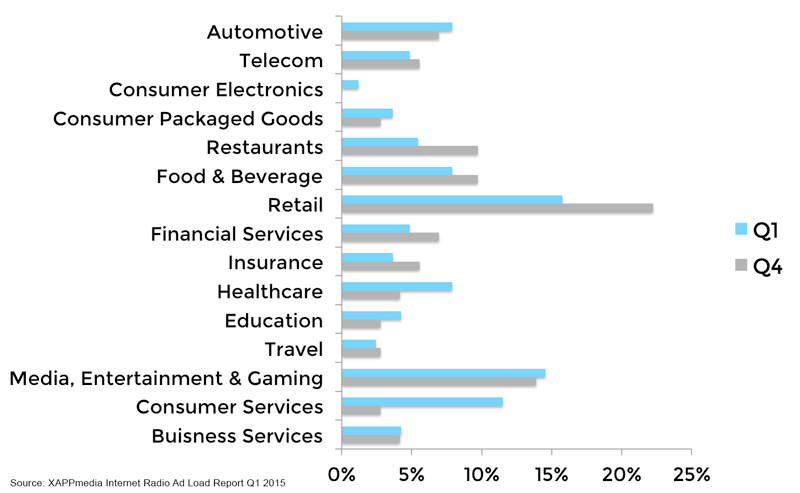

Retail Leads Q1, By Just a Little

In the heart of the 2014 holiday season, no one was surprised that retailers were the most frequently identified advertisers. Retailers were still the most likely to appear in Q1 2015 but the industry was only narrowly ahead of the Media, Entertainment and Gaming category. The narrowing was driven by a relatively large fall in retailer presence compared to a narrow climb for Media, Entertainment and Gaming.

The biggest industry gains were Consumer Services and Healthcare. By contrast, Restaurants, Financial Services and Insurance all fell in presence relative to other industries.

The proper way to interpret this data is the breadth of advertisers from a particular industry. It is not a spot load share that you might see in a broadcast radio analysis. See below for advertiser concentration by audio publisher. Look at these numbers as indicating the success of Internet radio in getting more advertisers on board and the relative mix across industries. In Q4 2014, Internet radio relied on retail for 22% of its advertisers but the industry represented only 16% in Q1 2015. The decline in reliance on a single industry is another positive trend for Internet radio.

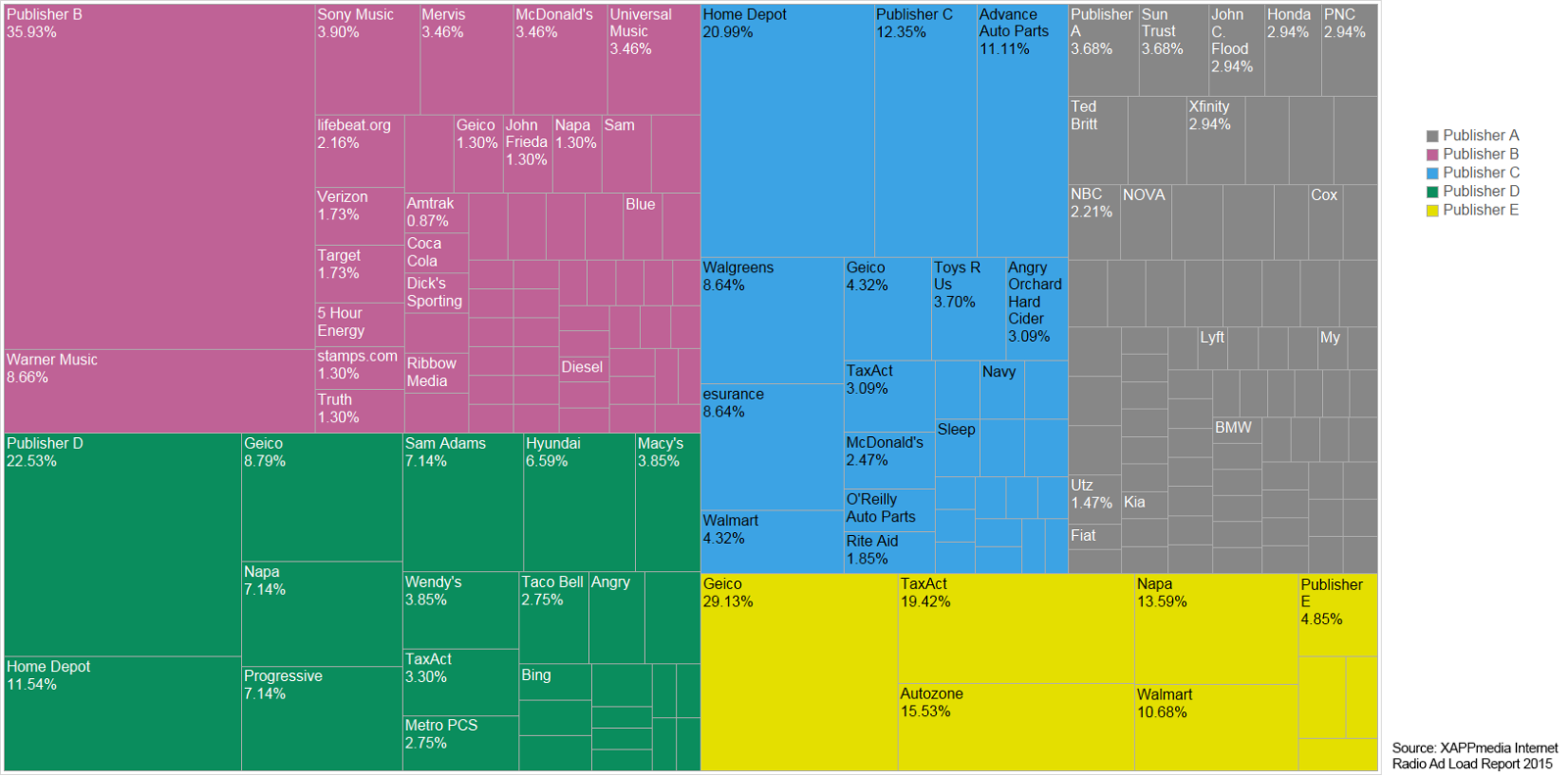

Understanding Advertiser Density

Advertiser density by publisher is similar to spot load share in broadcast radio. This analysis was first introduced in XAPPmedia’s most recent Ad Load Report. This captures the share of total ads identified on a platform that were attributed to a single advertiser. For example, Progressive Insurance accounted for 7.14% of ads on Publisher D (green section) during Q1. Similarly, esurance accounted for 8.59% of ads on Publisher C (blue section) in the quarter.

What does this data reveal? It shows that different publishers have wide variations in advertising sales strategies and outcomes. Publisher A has the least advertiser concentration with no single advertiser accounting for more than 3.68% of ads served. Publisher B also has low advertiser concentration. It runs a lot of its own “house ads” followed by Warner Music at 8.66%. However, when you remove the “house ads” promoting its own services and the two music labels, you see a similar spot concentration of 3.46% commanded by retailer Mervis Diamond. That is roughly comparable to the concentration for Publisher A for non-music industry advertisers.

By contrast, Publishers E has the highest advertiser spot load concentration with GEICO commanding at 29.13%. It is very reliant on GEICO. Even the software company Tax Act consumed nearly 20% of the spot load on Publisher E in Q1. Given that tax season has now passed, we expect that to change in Q2.

Another point worth noting is that Home Depot is the top external advertiser on both Publisher C (20.86%) and D (11.54%). However, as more advertisers begin incorporating Internet radio into their annual advertising budgets, we don’t expect Home Depot and GEICO to continue to command such high spot load share.

Related Posts

Internet Radio in Q1 – Ad Load Falls, New Advertisers Rise

Download the Internet Radio Ad Load Report – Holiday 2014

Internet Radio Trends Report 2015