The best word to describe the Internet radio and streaming advertising landscape in Q3 2015 is dynamic. Q2 ended with Google Play Music introducing an ad-supported listening option to complement its subscription-only business and Apple transformed the ad-supported only iTunes Radio into the subscription plus advertising Apple Music. As Q3 progressed almost all eyes were on Apple Music’s 11-15 million trial users and the “will they” or “won’t they” subscribe question. Advertisers seemed to be the one group not to care. Advertiser participation and diversity increased in the quarter, making that part of the business look more robust than ever despite an industry focus on subscriptions.

The best word to describe the Internet radio and streaming advertising landscape in Q3 2015 is dynamic. Q2 ended with Google Play Music introducing an ad-supported listening option to complement its subscription-only business and Apple transformed the ad-supported only iTunes Radio into the subscription plus advertising Apple Music. As Q3 progressed almost all eyes were on Apple Music’s 11-15 million trial users and the “will they” or “won’t they” subscribe question. Advertisers seemed to be the one group not to care. Advertiser participation and diversity increased in the quarter, making that part of the business look more robust than ever despite an industry focus on subscriptions.

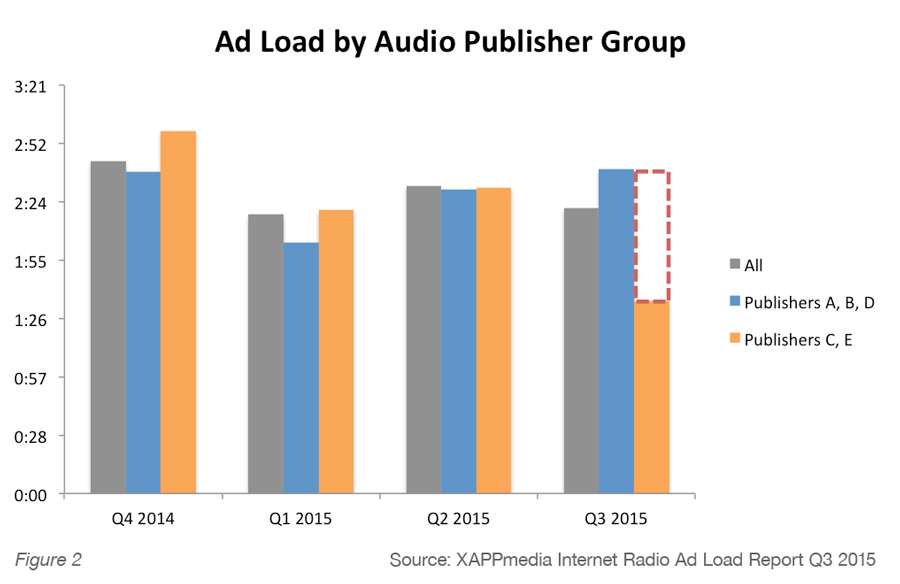

At the same time, two streaming services that traditionally ran ad load at or above the industry average dramatically dropped ad load while three others introduced a slight increase. We will not know for a couple of quarters if these strategies were a reaction to Apple Music or part of a longer-term strategy. However, we can expect Q4 will continue as a battle for audience and advertisers.

Today, XAPP published the Q3 Internet Radio Ad Load Report. Key summary findings include:

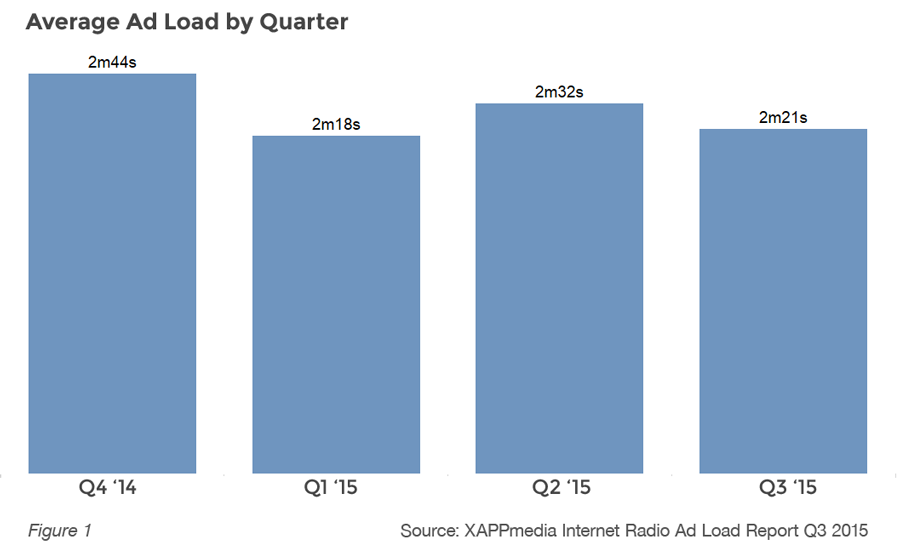

- Average Ad Load fell 7% to 2 minutes 21 seconds (2:21) per listening hour. However, that was led by two audio publishers that dropped ad load by 37% in the quarter, while three other publishers raised ad load collectively by 7%. Analysis is below and in the report.

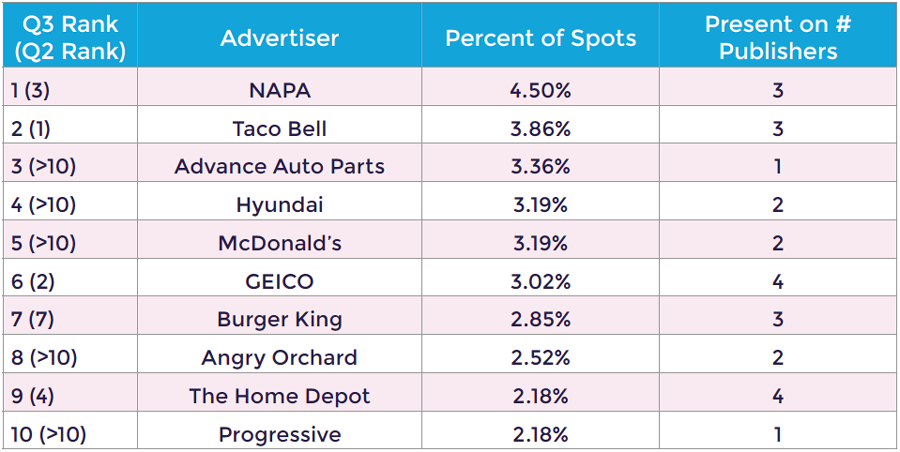

- Advertiser concentration decreased across the industry. In Q2, the top ten advertisers accounted for 41% of the spots in our sample. The third quarter saw that total decrease to only 31%. An example can be found at the top of the list. NAPA had the third highest number of spots in Q2 with 5.2%. However, they had the number one ranking in Q3 while only accounting for 4.5% of spots.

- Despite the divergence in average industry ad load, the median ad load is remarkably consistent. The median session ad length was 2 minutes and 30 seconds (2:30) for Q3 2015 and it was the same across all sessions going back to Q4 2014.

Ad Load Falls… or rises… it depends where you look

Ad load on Internet radio declined sequentially in Q3 from Q2 2015. Overall, a 7% decline in ad load across the five publishers we track other than Apple Music was recorded.

However, the entire decline can be attributed to a 37% ad load decrease at audio Publishers C and E. These two publishers had consistently delivered ad load at or above the industry average between Q4 2015 and Q2 2015 before the Q3 decline. By contrast, Publishers A, B and D increased ad load an average of 7% in the quarter to 2 minutes 40 seconds per listening hour. A detailed analysis by publisher by quarter and month is included in the full report.

Advertiser Spot Load Concentration Falls

In Q3, we again tracked spot load by advertiser and the top spot for the quarter went to NAPA, followed by Taco Bell and Advance Auto Parts. As indicated in the summary, the top 10 advertisers accounted for 41% of all ads identified in Q2, but only 31% in Q3. Seventy-five new advertisers were also identified in Q3 for the first time. The reduction in advertiser spot load concentration and introduction of new advertisers suggests that the Internet radio advertiser ecosystem is robust and becoming more diverse. A detailed analysis of advertiser spot load and advertisers by publisher is included in the full report.

Ad-supported Listening Continues to Flourish

Third quarter results reinforce the dynamic nature of the Internet radio market for streaming music. While publishers experiment with ad serving strategies in order to balance revenue capture with listener experience, the clearest trend is that more advertisers continue to look to Internet radio for access to a large domestic consumer audience. This trend should continue during the heaviest advertising time of the year, Q4. Full year 2015 numbers will be published in January and will integrate results from Apple Music (iTunes Radio).

If you have any questions, drop us an email at info@xappmedia.com.

Related Posts

More Local Advertisers and Higher Ad Load on Internet Radio in Q2

New Apple Music Ad Load Report

Internet Radio in Q1 – Ad Load Falls, New Advertisers Rise