Sometimes you simply must face reality instead of wishing for a new one. On Monday, Pat Higbie referenced Strategy Analytics research that concluded 89% of Internet radio listeners today choose ad-supported listening over subscriptions and that rate is not expected to change in the next six years. New data released yesterday by Pandora sheds additional light on the economic forces behind these decisions. This data from U.S. consumers correlates closely with results from a 2011 survey of U.K. listeners on willingness to pay for music service subscriptions.

Behind all of this consumer sentiment, you can see conscious trade-offs between substitute audio offerings – most of which generate no additional revenue for recording artists and labels. The evidence is piling up in support of Internet radio’s ad-supported future.

Ad-Supported Listening Doesn’t Displace Subscriptions

Industry labels, the music royalty collection organizations such as SoundExchange, and some artists have called for the reduction or removal of ad-supported listening in order to increase subscriptions. They champion this approach primarily because the royalty rates are higher per track played for most contracts with on-demand subscription services. However, data show that ad-supported listening is not displacing higher rates of consumer subscriptions.

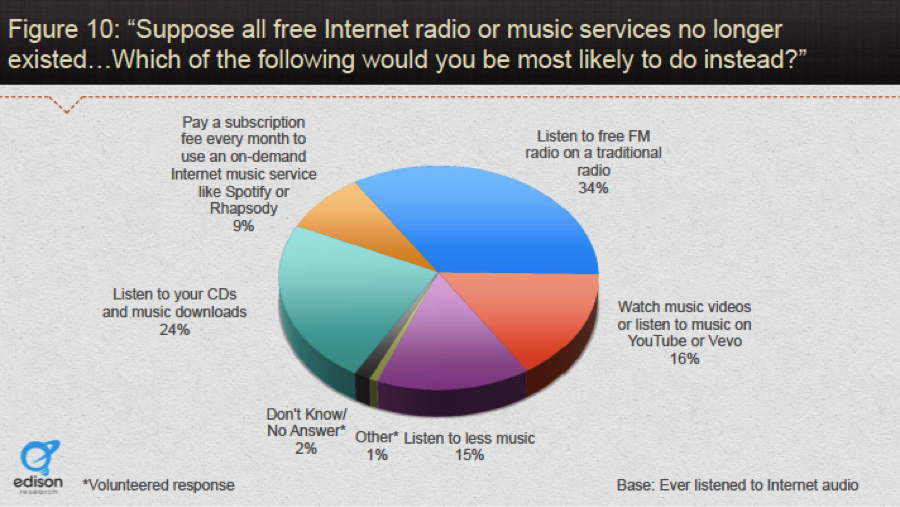

The data from Edison Research indicates that only 9% of current ad-supported listeners would choose to subscribe if that were the only option. How could this be? It is really simple. These consumers have already chosen the trade-off of listening to ads instead of paying for a subscription. If ad-supported Internet radio services were not available they would simply seek out other ad-supported, no payment options or listen to less music.

Fifty percent said they would simply listen to broadcast radio or get their music from a video service such as YouTube. By law, the former provides no royalty income to performers or labels and the latter has monetization returns lower than Internet radio. Digging a little deeper, you see that another 39% of consumers would either listen to less music or stick with their own, purchased music. Again, no incremental industry revenue would be generated. Removal of subscription revenue would appear to be a net loss for the industry.

Ad-Supported Still Preferred Even with Lower Subscription Rates

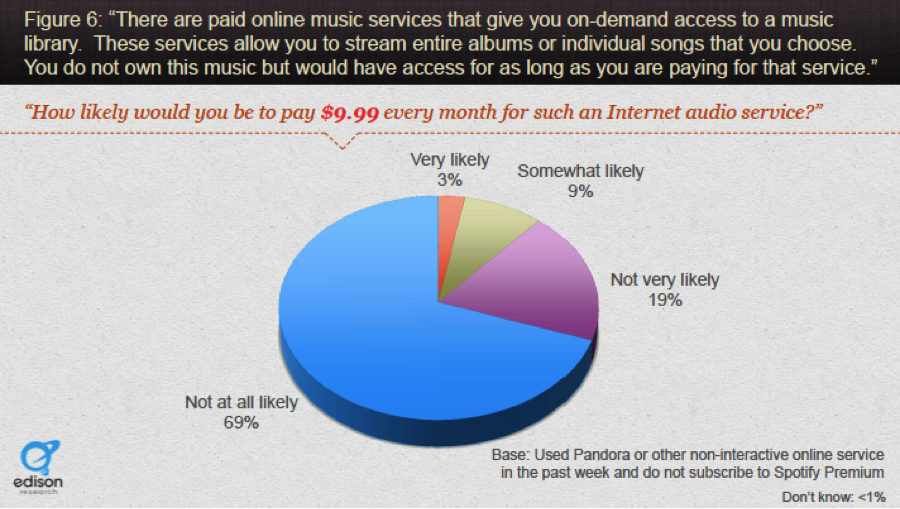

Another question for subscription advocates is whether lower subscription rates would increase the number of subscribers. The answer is yes, but ad-supported would still be the dominant form of listening. At the $9.99 rate, only 12% of consumers said they would be “very likely” or “somewhat likely” to subscribe to an on-demand music service. We know that “somewhat likely” responses will often not follow through, so the actual subscription rate would be smaller and maybe closer to the “very likely” number of 3%.

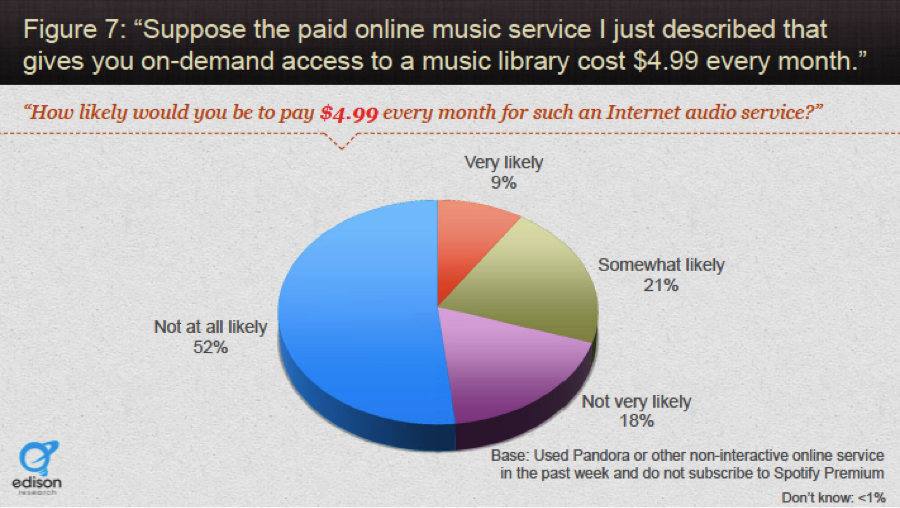

When the question reduces the subscription rate by 50% to $4.99, the “very likely” and “somewhat likely” increase to 30%, but only 9% say they would be very likely.

This assumes that all of the people who indicated that they would be very likely to subscribe at $9.99 would also subscribe at $4.99. This means an additional 6% of Internet radio listeners would almost surely subscribe if the lower rate were offered. The “very likely” cohort tripled. The “somewhat likely” cohort was closer to a doubling, moving 2.33 times from 9% to 21%.

Even if you were to lower prices to $2.99 per month, only 21% say very likely and another 21% say “somewhat likely.” Three of every five listeners would still opt for ad-supported listening at the cost of one Starbuck’s coffee per month for unlimited, on-demand music.

It is worth noting that the music service described in the question is similar to Rdio Unlimited, Slacker Premium, or Spotify Premium. All are priced currently at $9.99 per month. Pandora’s premium offering, Pandora One, is priced at $4.99 per month, but it does not include the on-demand music selection features. In order for users to be able to select preferred tracks or albums for immediate play, the service must have a direct contract with the music rights holders. The ability of these services to reduce this pricing is limited by those contracts. As a result, the hypothetical $4.99 service is truly hypothetical today. Welcome to the byzantine world of music licensing.

Consistency with Other Data

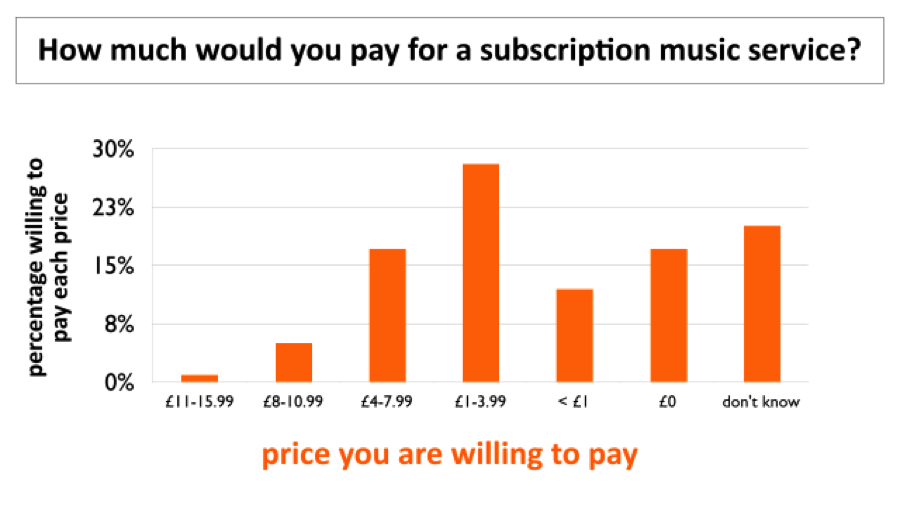

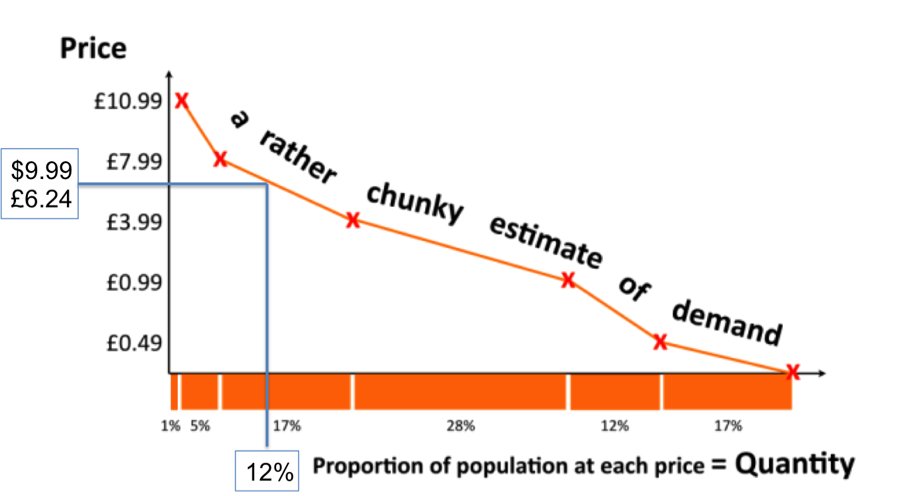

If you consider the Edison Research data as a whole, it aligns well with the Strategy Analytics estimates of no more than 11% of consumers opting for ad-free subscriptions today. It is also consistent with data compiled by NewMediaAge in 2011 in the United Kingdom as reported and analyzed by David Touve of the University of Virginia in the publication Rockonomics.

Professor Touve very conveniently mapped out the data for us on a demand curve that makes it easy to show where $9.99 would likely fall in terms of subscribers. In 2011, the pound to dollar conversion rate averaged almost exactly 1.6. That means $9.99 was equivalent to £6.24. At that price, the survey data predicts demand for subscriptions would be about 12%. This is identical to Edison data when you combine the very likely and somewhat likely consumer responses and only 1% off of the Strategy Analytics estimate. There are many factors to consider including methodology variance, but it is striking how closely all of these independent studies align.

Ads are Here to Stay – Listeners Have Spoken

As we mentioned in the Internet Radio Ad Load Report published last week, advertising is and likely will remain dominant economic driver for the industry. Through their actions and survey responses, consumers are consistently choosing ad-supported listening by a large margin over subscriptions. This should not surprise anyone. Broadcast radio continues to be dominated by ad-supported listening despite the subscription-based satellite radio option. Why should consumer behavior in regards to subscriptions be different for Internet radio?

Since ad-supported listening is the future of Internet radio economics, optimizing advertising revenue is critical for an industry plagued by high content costs. The fact that ad loads seem to be optimized at around three minutes per hour (about 1/3 to 1/4 of broadcast radio), increasing ad rates will be the top economic priority for industry executives.

Related Posts

Internet Radio’s Ad-Supported Present and Future

Internet Radio Ad Load Report – Holiday 2014

Streaming Growth is Not Undermining the Recording Industry