There is a lot of talk about subscription-based revenue models for Internet radio and streaming services. At XAPP, we think subscription offerings make a lot of sense when providing features such as on-demand song streaming and saving tracks directly to your mobile device. That model is similar to music ownership and data suggests it will constitute a minority of listening. Research firm Strategy Analytics estimates that subscriptions won’t exceed 11% of the market for the foreseeable future.

There is a lot of talk about subscription-based revenue models for Internet radio and streaming services. At XAPP, we think subscription offerings make a lot of sense when providing features such as on-demand song streaming and saving tracks directly to your mobile device. That model is similar to music ownership and data suggests it will constitute a minority of listening. Research firm Strategy Analytics estimates that subscriptions won’t exceed 11% of the market for the foreseeable future.

Traditional music ownership models benefited tremendously from the ubiquitous ad-supported listening on broadcast radio. Consumers liked access to music that they hadn’t heard or didn’t have with them at the time. This exposure often led to purchases of music first discovered on radio and concert attendance that generated additional revenue for artists. Ad-supported listening on Internet radio is the logical complement to the on-demand subscription model and will be the much larger platform for music exposure to consumers and a larger revenue source for artists. If on-demand streaming services represent today’s version to music ownership, then Internet radio is the new broadcast radio equivalent.

Addressing a False Conflict

Some record label executives are attempting to position ad-supported Internet radio as undermining subscription services. The data suggests the opposite. The most successful subscription music streaming service in terms of audience is Spotify with 15 million subscribers. Of that, the company asserts 80% started out listening to ad-supported streams.

That means twelve million of Spotify’s subscribers made the leap because they were first exposed to the ad-supported service. When we add up the $120 annual subscription fee, that comes to $1.44 billion in revenue of which over $1 billion goes to artists and labels. The forty-five million ad-supported Spotify users generate revenue for artists and their labels today and they also are candidates for future subscriptions. We can see from these data points that ad-supported listening can have a big impact on music industry revenue in multiple ways.

Ad Supported Isn’t Free, and Doesn’t Displace Purchase

It’s worth noting that ad-supported listening isn’t free listening. Consumers exchange their time listening to ads for the opportunity to listen to music in a radio format. Unlike on-demand subscription services, they do not get to choose the song they want to hear and listen to it instantly. From a legal standpoint these are called interactive (ownership-like) and non-interactive (radio-like) services respectively.

On Internet radio consumers choose an artist or song or genre and the service plays a variety of music. This is similar to broadcast radio formats that play songs of a particular genre. The key difference is that the users receive about 75% fewer ads and performing artists actually get paid for plays on Internet radio, whereas they receive nothing from broadcast radio.

The false conflict also ignores another fact. There is no evidence to suggest ad-supported Internet radio listeners abandon music purchases. While on-demand streaming mimics music ownership, ad-supported Internet radio doesn’t displace music purchases any more than broadcast radio. If people want immediate access to their favorite songs or to create their own personal playlists on a mobile device, they still must purchase the music. In this way, the $10-$15 that typical ad-supported users generate annually is incremental to the average spend on purchased music.

The false conflict also ignores another fact. There is no evidence to suggest ad-supported Internet radio listeners abandon music purchases. While on-demand streaming mimics music ownership, ad-supported Internet radio doesn’t displace music purchases any more than broadcast radio. If people want immediate access to their favorite songs or to create their own personal playlists on a mobile device, they still must purchase the music. In this way, the $10-$15 that typical ad-supported users generate annually is incremental to the average spend on purchased music.

Spotify cites research from NPD Group that suggests 45% of Internet users purchase music of any kind and spend $55.45 annually. If we assume $10 annually in ad-supported listening revenue for these users, Internet radio is creating an 18% annual uplift in consumer revenue. For the 55% of consumers that purchase no music annually, that $10 is found money.

If someone were to contest that non-interactive Internet radio displaces all music purchases they would have to make the same assertion about broadcast radio historically displacing owned music. That clearly isn’t the case. In fact, there is ample evidence that music exposure in broadcast and Internet radio actually increases music purchases.

Insiders are Focused on Ad-Supported Model

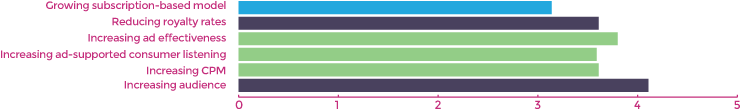

Since Internet radio and streaming services today earn 5-10 times more revenue from a subscriber than an ad-supported listener you would think they would focus their attention on subscriptions. The recent Internet Radio and Streaming Report from RAIN News and XAPPmedia surveyed over 300 industry insiders for their perspective. When presented with the opportunity to rank the importance of six industry topics, growing the subscriber base comes in dead last.

What came in as a higher priority than subscriptions? Four advertising related topics led the pack: increasing audience, increasing ad-supported listening, increasing ad effectiveness and increasing CPM. The industry insiders know that a big part of their future is advertising and assign it a 15-20% higher priority than subscriptions. They also understand that pricing pressure is likely to bring down subscription rates over the next few years and advertising will represent a growing percentage of revenue over time.

It’s not either, it’s both

There is clearly a place for both subscription and ad-supported streaming services. As previous economic and consumer research analysis shows, only a small percentage of consumers will adopt subscription music services even at price points much lower than prevail today. The majority will opt for ad-supported listening that will generate increasing amounts of revenue for streaming services, artists and music labels. Ad-supported listening is already generating over $1 billion in the U.S. annually and is growing rapidly.

Music industry revenue witnessed a sharp decline over the past 15 years. Internet radio is helping the industry grow again and advertising revenue is a big part of the turnaround.

Related Posts

New Data: Consumers Prefer Ad-Supported Listening

Internet Radio’s Ad-Supported Present and Future

Streaming Growth is Not Undermining the Recording Industry

iPhone/Beats Image Source: 9to5Mac