On Tuesday, RAIN News and XAPPmedia revealed the results of a recent survey of audio industry insiders. We already discussed the expectations for broadcast radio ad loads to remain flat over the next three years. For Internet radio, the expectation is growth in both total listening hours and ad load. When you combine growth in expected listening hours and increases in ad load, overall ad inventory is likely to climb about 20% per year. Let’s break those numbers down.

Ad Inventory to Expand Due to Higher Listening Hours and Ad Load

First, the biggest driver of advertising inventory is the total amount of listening hours. Each listening hour reflects the opportunity to serve ads. While the growth in users of Internet radio and streaming services is well documented, there is less attention paid to listening hours. Now that more than 50% of U.S. consumers are using Internet radio, the key question is how much of their audio consumption time will migrate from broadcast and other traditional media sources.

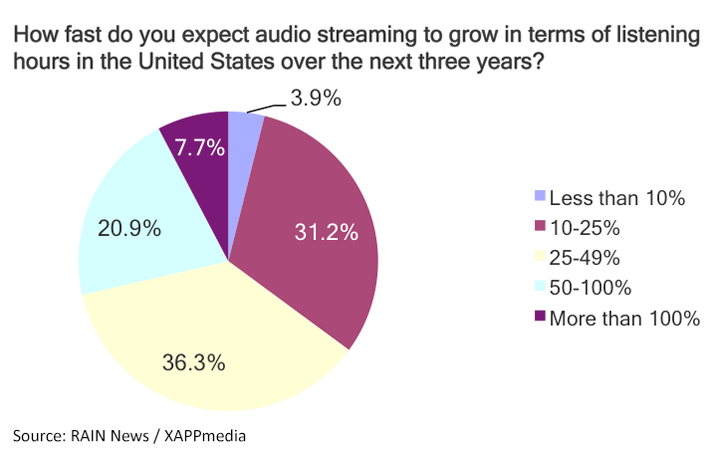

About one third of industry insiders expect listening hours to expand between 25% and 50% over the next three years while nearly 30% expect growth over 50%. A weighted average analysis predicts expansion of 42.7% over the period. This reflects an annual growth rate of 12.75%.

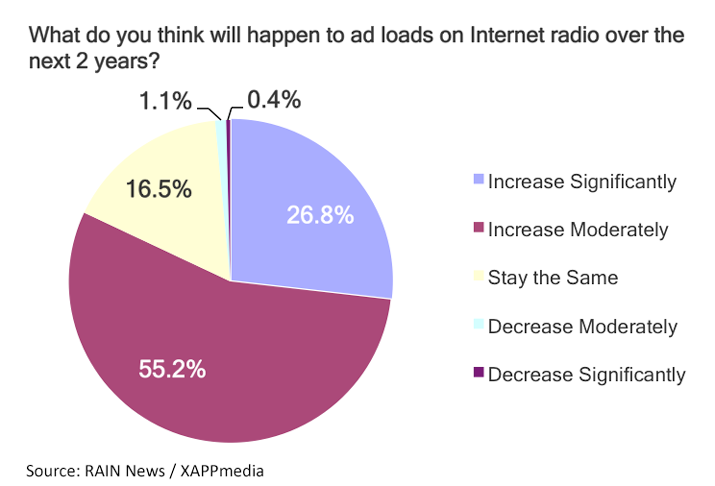

Ad load is the number of ads served per hour of listening. Over 55% of survey respondents expect moderate growth in this area and 80% expect either moderate or significant growth. We estimate the growth from these responses to be 14.7% over two years or 7.2% annually.

When you consider these factors combined, more hours to serve ads plus more ads per hour, you have a total industry ad inventory rise of 20% annually over the next two years.

The Three Minute Ad Load Cap and Importance of Ad Rates

Higher inventory would normally mean the ability to generate more profitability. In this case, more listening hours also comes with higher costs for royalty rates paid by music streaming services. That means the two primary levers to increase revenue and profitability are ad load and ad rates.

All of the publishers appear to be targeting a three-minute ad load as the cap for the trade-off between user experience and the need to monetize content. Since competition is so fierce for audience today, moving ad load too high risks alienating consumers at a time when growth is paramount. The predicted moderate increase of 15% would put the industry average right at three minutes, up from 2.69 minutes today according to the recent Internet Radio Ad Load Report.

Given the constraints around ad load, expect strategies for driving profitability to focus primarily on increased ad rates. While there are some success stories of increasing ad rates in the market – such as Pandora’s shift to local advertisers, the introduction of video ads at Spotify, and NPR’s use of XAPPmedia’s Interactive Audio Ads – the expected increase in ad rates will need to outpace the significant annual increase in ad inventory. That means the use and frequency of these premium ad units will need to climb rapidly.

Making a Bigger Impact with Advertising

We know from Strategy Analytics and Edison Research data that around 90% of users of Internet radio and streaming services will choose ad supported listening. That suggests the economic drivers of advertising will be critical to the industry’s success. Given the industry cost structure and user experience mechanics, it looks like improving ad rates will be the most important factor to watch.

Related Posts

Are Broadcast Radio Ad Loads Sustainable?

Internet Radio’s Ad-Supported Present and Future

New Data: Consumers Prefer Ad-Supported Listening