Last week, XAPPmedia released the 2015 Internet Radio Ad Load Report and there is an entire section on the advertisers themselves. In 2015, the XAPPmedia sample identified 406 distinct advertisers across five leading Internet radio apps. When you add Apple Music into the mix, that number grew to 487 as there was little overlap among advertisers on the service with its competitors. This reflects growth of more than five times over what we identified in Q4 2014. Leading the pack of these 400-plus advertisers in spot load for 2015 were The Home Depot and GEICO.

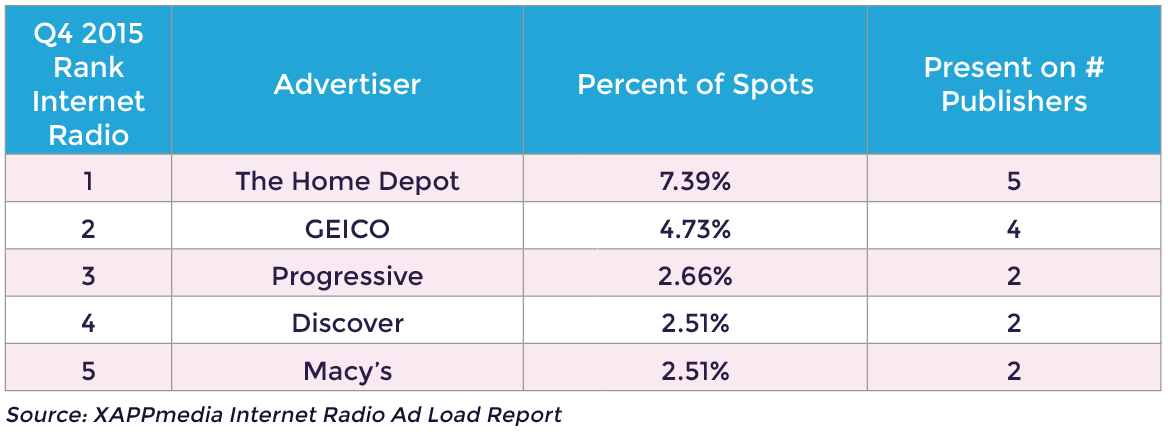

Each of the top four advertisers recorded a top spot load honors in one quarter: GEICO in Q1, Taco Bell in Q2, NAPA in Q3 and The Home Depot in Q4. The fourth quarter results for 2015 followed the annual trend with The Home Depot and GEICO also taking the top two spots. However, two advertisers, Discover and Macy’s made the top five in Q4 without placing in the top 10 for the full year.

Internet Radio Spot Load Looking More Like Radio Spot Load

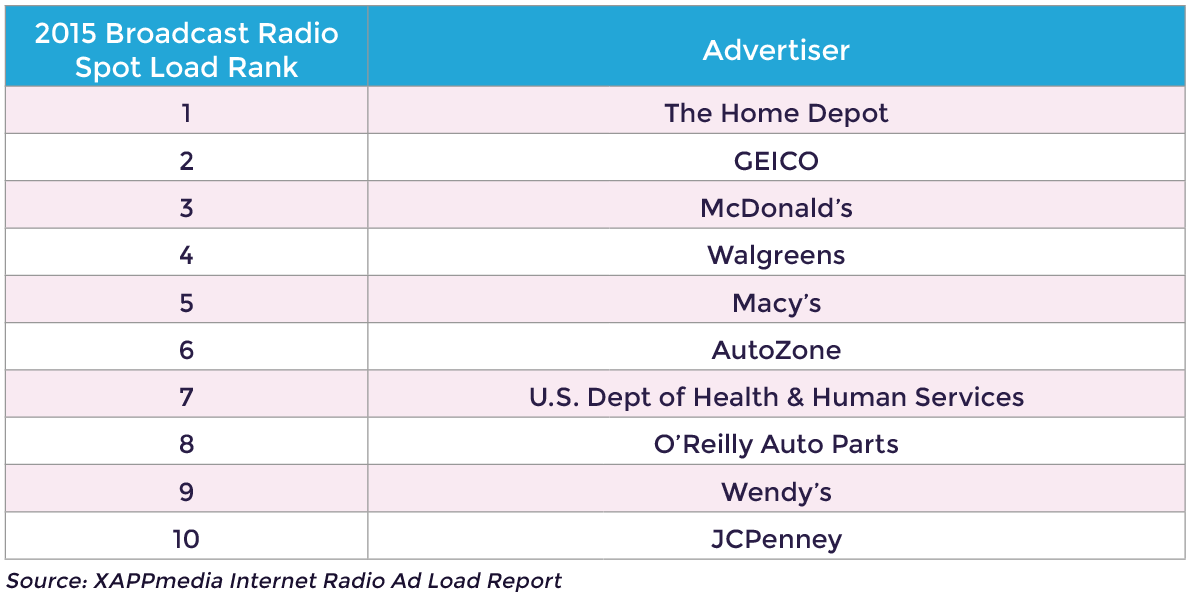

Some radio broadcasters have frequently expressed the belief that advertisers see Internet radio as a digital channel. The implication behind the belief is that the advertisers are different on broadcast and Internet radio and that the budgets come out of digital and not the traditional broadcast bucket. The latter point is unlikely and we can formally dispel the different advertiser myth by comparing the Internet radio spot load numbers with those from broadcast in 2015.

The top two slots for 2015 are the same for broadcast and Internet radio and three of the top 10 are on both short lists. In addition, only the U.S. Department of Health and Human Services made the broadcast radio top 10 spot advertisers and didn’t show up on Internet radio. On Internet radio in 2015, McDonald’s held the 12th spot, Macy’s 25th, Walgreens 28th, Wendy’s 29th, JCPenney 64th, and O’Reilly Auto Parts 68th.

Insurance, Auto Parts, Food, Alcoholic Beverages and Retail

Internet radio’s top 10 spot advertisers reflects close alignment with broadcast radio advertisers. When you explore the list further, you find an increasing number of local advertisers that you would also expect to hear on broadcast. The difference is that brands with more moderate ad budgets such as Sam Adams and Angry Orchard can command a high spot load share in Internet radio today if they commit to it. As the largest advertisers migrate more budget to Internet radio over the next two years, it will become harder for small brands to make the top 10 list even as they maintain a significant presence.

The other finding from our analysis is a significant consistency among top brands using Internet radio advertising throughout the year. The top 10 advertisers would fluctuate from quarter to quarter but the top 50-75 remained consistent. This reflects a long-term commitment by brands to reach a U.S. audience that will approach 180 million monthly listeners in 2016.

[su_button style=”flat” size=”6″ background=”#D73C90″ radius=”0″ url=”https://go.pardot.com/emailPreference/e/35552/300″ target=”_blank”]Subscribe to XAPP Blog[/su_button]

Related Posts

Download Internet Radio Ad Load Report Q4 2015: Advertisers Grow 5x in 2015, Ad Load Up 5.7%

Media, Entertainment and Gaming Group Had Top Numbers of Internet Radio Advertisers in Q3

Q3 Report: Internet Radio Ad Load Strategies Diverge