There has been a lot of talk since Apple acquired Beats last year about the impact the re-introduced streaming service could have on the industry. Conventional wisdom suggested it would be a big threat to Spotify. Beats was a subscription-only service and focused on curated playlists. When it first came to market, there was widespread speculation that Beats might take market share from Spotify. That didn’t happen. Spotify’s growth only accelerated and Beats all but shut down after the Apple acquisition.

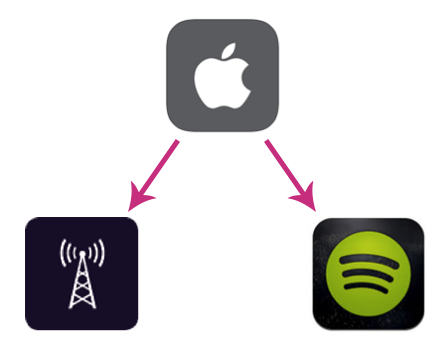

Yesterday, Apple Music was announced and it sounds very Spotify-like. There is a $9.99 monthly subscription price – the same as Spotify. There is a family plan – same goes for Spotify. It recommends songs, you can share music with friends, there are videos – all features Spotify has introduced previously. Spotify has been enormously successful at growing audience globally and has the best track record of converting users to subscriptions. It’s not surprising that Apple copied many of its standard features and added a little fairy dust to differentiate around the margin.

But, the biggest difference is what Beats has become: a conventional radio station inside of Apple Music.

A Wake-up Call for Broadcasters

You need only watch the Apple broadcast from its Worldwide Developers Conference (WWDC) starting at 109:30 into the video. Beats 1 was heralded as “24/7 global radio.”

Radio has had a lot of defenses against mass migration to streaming services. First, Internet radio and streaming services were saddled to computers, which is not where most people listen. When steaming first moved to mobile devices it was still hard to get it to work in the car – so the automobile became a refuge for broadcast radio from the new competitors. However, Bluetooth connectivity is now plentiful in cars and in-dash systems with streaming services are becoming common. Then there was the discussion of human curation being better than algorithms, but several services now use DJs and other professionals to create playlists.

However, everyone recognizes that even streaming services with corporate personalities don’t have human personalities like radio stations. They don’t have the interviews and commentary that DJs and hosts provide. They don’t have the trust the personalities develop with audiences. Apple is aiming right at this programming feature. Eddy Cue, an Apple Senior Vice President said this about Beats 1:

“The truth is, Internet radio isn’t really radio. It’s just a playlist of songs. So we wanted to do something really big. We wanted to create a worldwide live radio station broadcasting around the globe and we’ve done that with Beats 1. [http://www.apple.com/live/2015-june-event @ 116:12 in the video]

Beats 1 is striking at the heart of radio. It is going after today’s radio listening time and has hired Zane Lowe, Ebro Darden and Julie Adenuga as its core line-up. There is a risk here that Lowe could become for music and Beats what Howard Stern was for mornings on SiriusXM – the source of large audience migration from broadcast to satellite radio. Could Lowe and crew become a must-listen for those wanting to be in the know?

Internet radio and streaming services were offering substitute products for radio but competed more for time with owned music and video. Beats 1 is a directly competitive product. Apple is actually rolling out competition for consumer attention on both fronts.

Will This Get Radio Committed to Mobile

Broadcast radio still has several assets: habits, economics and local programming. Consumer habits of radio listening are shifting, but they are still strong and radio provides more daily reach than any other media in the U.S. The problem here is that the trend lines are unfavorable both overall and demographically.

Broadcasters have favorable economics because they are not required to pay performance royalties in the U.S. However, there is an assault on that legal framework by artists’ groups that is getting more traction than any point in the past. Finally, some broadcasters still have local personalities and connections that help keep their audience loyalty strong. That might be the most enduring asset of all.

Last week we talked about the $5 billion opportunity presented by mobile Internet audio and we have discussed the streaming opportunity for broadcast in the past. It is there for online pure plays and broadcasters alike. While some broadcasters have been aggressive about their online strategies – iHeart Media comes to mind – most have taken only tepid steps. Broadcasters know a lot about audience development and programming that could be an asset when competing for listeners over the next decade. Tools like jacapps can help them launch high quality mobile listening apps and the JAX service can even help them monetize their mobile audiences.

Apple Isn’t Just Going After Spotify’s Audience

Apple may well struggle with its new global radio service. It wouldn’t be surprising if issues arose and it took time for the Beats 1 audience to grow. Let’s face it; iTunes radio didn’t kill off anyone. However, this seems different. Apple appears committed. These services are coming out on Apple, Windows and Android platforms. The window of opportunity for broadcasters may be closing as another traditional radio asset comes under assault.

Apple may well struggle with its new global radio service. It wouldn’t be surprising if issues arose and it took time for the Beats 1 audience to grow. Let’s face it; iTunes radio didn’t kill off anyone. However, this seems different. Apple appears committed. These services are coming out on Apple, Windows and Android platforms. The window of opportunity for broadcasters may be closing as another traditional radio asset comes under assault.

We will learn a lot about Beats 1 on June 30th and in the coming months. The dominant storylines are bound to focus on the impact on Spotify because it is already receiving a lot of media attention and the narrative is easily understood. The radio story won’t receive as much attention, but the impact may well be greater. Sony Music CEO Doug Morris said at the Midem conference this past weekend, “I believe most of the consumption of music now will be done through streaming.” Will broadcast radio take action to beat back the many growing and potentially existential threats? That is a narrative worth watching.

Related Posts

New Data: Consumers Prefer Ad-Supported Listening

Internet Radio’s Ad-Supported Present and Future

Streaming Growth is Not Undermining the Recording Industry