As we mentioned in Part One of this series last week, consumers are voting with their ears. Internet radio was not displacing much broadcast radio listening when it was primarily a desktop computer phenomenon. That has changed with the rise of mobile devices. Whether it’s the convenience, choice, personalization or lower ad loads, more consumers are listening to Internet radio on mobile and they are increasing their time spent listening each year.

This shift in consumer listening is also showing up in another set of numbers: advertising revenue. According to the Radio Advertising Bureau (RAB), traditional broadcast radio advertising sources such as network and spot declined last year 4% and 1% respectively, while Internet radio revenue grew rapidly. In fact, the area that is offsetting broadcast radio’s spot advertising slide is a 15% rise in digital revenue as station’s attempt to monetize digital audiences primarily through website banner ads.

Too often a review of these numbers in public forums devolves into a spirited defense of the value of radio and its supposed permanence in the media landscape. This statement may be true. However, permanence doesn’t assure an existence consistent with today’s structure. Numbers show a shift in consumer behavior and that ultimately will impact what broadcast radio looks like in the future.

Broadcast radio can learn from the print news industry’s experience. Print news publishers were too slow to react to changes brought on by the Internet and the industry is now smaller than at any time since 1950 in inflation adjusted revenue. No two industries are alike, even in media, and radio will certainly face a different set of challenges. However, mobile devices are to broadcast radio what the web was for print news. Broadcast radio has an opportunity to be relevant in both the broadcast and mobile Internet worlds, but it must act to embrace new opportunities.

The Print News Industry as a Warning

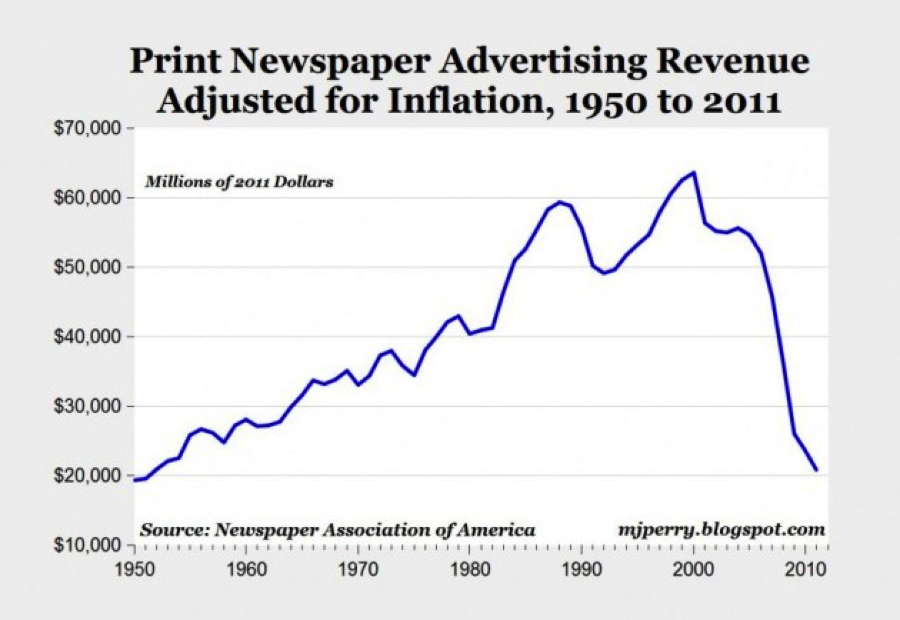

First let’s consider the experience of the print news industry. Print news may well have some permanence in the U.S. media landscape going forward, but it is now obvious that its present and future are quite different from its past. As the chart from the Newspaper Association of America shows, print news advertising revenue grew steadily between 1950 and 2000 with a couple of recessionary interruptions.

What followed was a steep revenue drop in 2000-2001, followed by a short stabilization before a precipitous fall starting around 2005. The recessionary pressure could have explained the first drop and indeed the historical chart would have predicted a similar magnitude fall. However, the rapid decline starting in 2005 was during a period of economic and advertising revenue growth.

What followed was a steep revenue drop in 2000-2001, followed by a short stabilization before a precipitous fall starting around 2005. The recessionary pressure could have explained the first drop and indeed the historical chart would have predicted a similar magnitude fall. However, the rapid decline starting in 2005 was during a period of economic and advertising revenue growth.

Source Daily Newspaper Circulation Trends, Communic@tions Management Inc. 2013

Source Daily Newspaper Circulation Trends, Communic@tions Management Inc. 2013

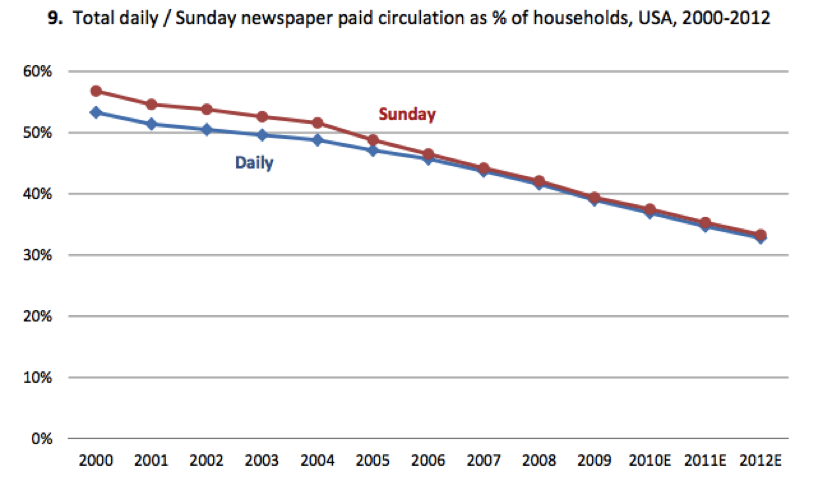

In addition, the percent of U.S. households with a paid print newspaper subscription was also falling but at a slower rate. The implication is that while print news was losing audience at about 2% of households per year, ad rates collapsed precipitating a 64% decline in ad revenue. The revenue decline is more than double the 30% fall in audience. This is when the industry could no longer deny the permanent structural change the Internet was exerting. It also provides a lesson that small audience declines can lead to outsized ad revenue deterioration.

What’s Different about Print and Radio

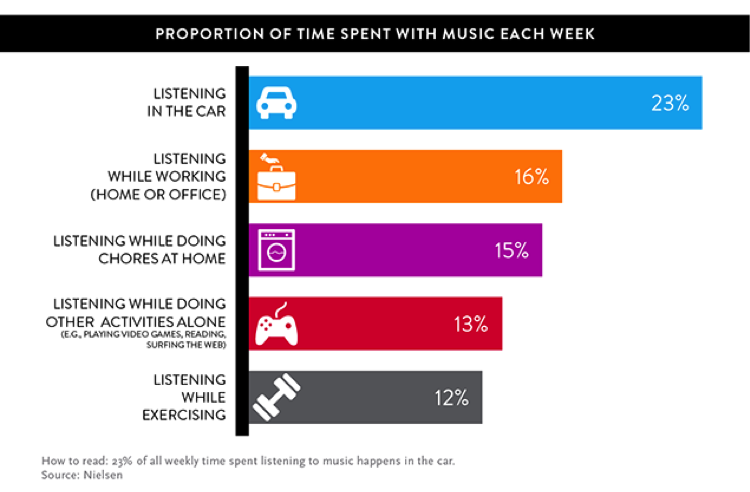

So why did the early Internet have such a large impact on the print news industry and not as much on radio? It comes down to a single word: mobility. Nielsen data shows that about 79% of radio listening takes place in situations when consumers are ultramobile and require hands free, eyes free audio consumption.

By contrast, print media consumption by definition requires visual attention and therefore has historically taken place while consumers were stationary. The desktop computer turned out to be a suitable substitute to print news for stationary information consumption. Not so with radio. Consumers simply didn’t have a computer in the places where they did most of their listening. The bulk of listening occurred in the car, at the gym, or while working. Broadcast radio emerged from this period relatively unaffected.

By contrast, print media consumption by definition requires visual attention and therefore has historically taken place while consumers were stationary. The desktop computer turned out to be a suitable substitute to print news for stationary information consumption. Not so with radio. Consumers simply didn’t have a computer in the places where they did most of their listening. The bulk of listening occurred in the car, at the gym, or while working. Broadcast radio emerged from this period relatively unaffected.

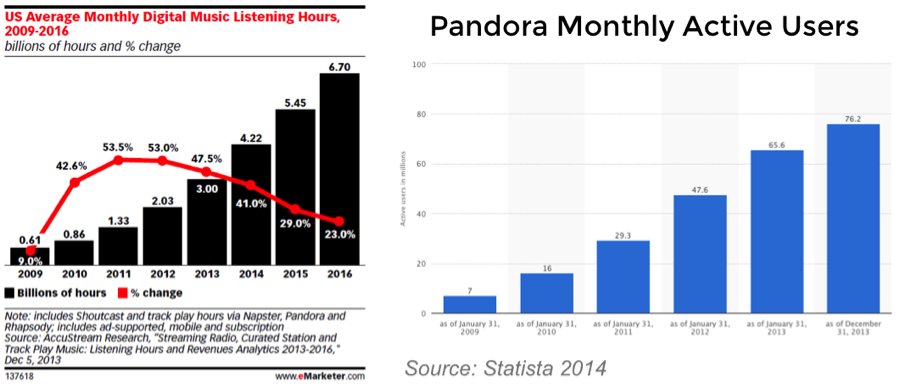

That has changed. Over 63% of Americans have smart phones in 2014 which means they have a computer with them all of the time. This has opened up new consumer listening opportunities for Internet radio that competes directly with time formerly spent on broadcast radio. While smartphone ownership increased by about 2.5 times during the period 2009-2013, total monthly Internet radio listening grew about 5 times and active monthly Pandora subscribers increased by 10 times.

Mobile Listening and Advertising Revenue

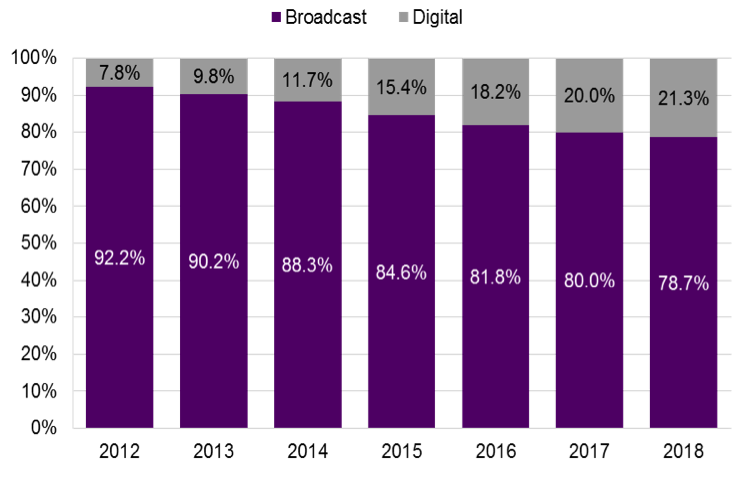

The smartphone driven mobile Internet is a threat to broadcast radio’s core user scenarios outlined in the Nielsen study. That is why the listening and revenue impacts are starting to be seen now. Forecast data from BIA/Kelsey and eMarketer tell a story that broadcast radio should no longer ignore. Radio delivered by digital means is expected to generate 21% of industry advertising revenue by 2018.

Source: BIA/Kelsey, eMarketer Analysis 2014

Source: BIA/Kelsey, eMarketer Analysis 2014

Some of that revenue will come from digital advertising budgets. However, a significant proportion is likely to be shifted from broadcast radio advertising budgets. There is an opportunity for broadcast radio to claim this digital advertising revenue that is expected to represent most of the industry’s revenue growth.

Mobile Can Be a Threat or Opportunity

If mobile devices are to radio what the web was to newspapers, then it’s time to think about growing with the trend as opposed to opposing it in futility. Streaming services on mobile have broken down traditional geographic boundaries and ushered in new era of audio consumption. Broadcast radio has largely sat on the sidelines in this consumer shift. When stations have participated they have typically simulcast the radio signal. That is a simple approach, but doesn’t exploit the added features consumers expect on mobile nor does it take advantage of the opportunity to engage audiences in real-time.

XAPPmedia was developed to help audio programming succeed on mobile devices in ways that drive better economics for the audio app providers and better consumer engagement for advertisers. Broadcast radio has an opportunity to leverage its programming expertise to build and maintain audiences across devices and even across geographies. Add localization of content for core audiences that crossover from radios to mobile devices and significant advertising opportunities could not only arrest an industry revenue decline, but usher in a new era of growth. XAPP Ads are commanding CPM rates on Internet radio that exceed premium spot rate equivalents on broadcast radio. This can help broadcasters transition to mobile with a viable economic model. However, broadcasters must first commit to a mobile future the complements its traditional analog model.

Related Posts

Streaming Growth is Not Undermining the Recording Industry

People Don’t Watch Radio

Internet Radio Advertising Hits an Inflection Point