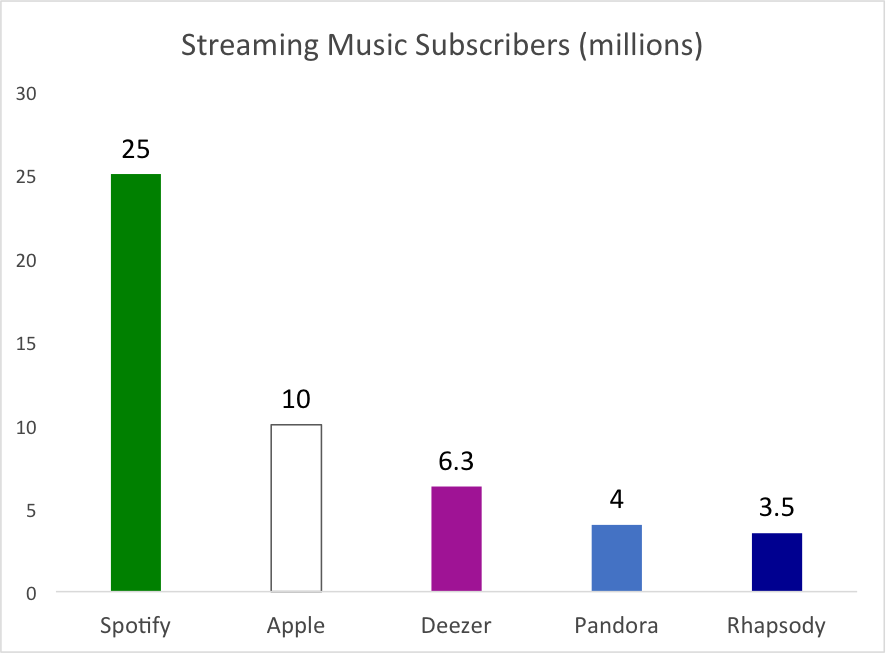

The Financial Times reported over the weekend that Apple Music has reached 10 million subscribers. This trails what The Verge estimates is over 25 million Spotify subscribers, but represents impressive growth just six months after launch. In October, Apple had a comparable subscriber base to Deezer’s 6.3 million paid listeners. It then grew an impressive 54% in the fourth quarter to become the clear global number two in subscribers. Rounding out the top five are Deezer, Pandora and Rhapsody.

The Financial Times reported over the weekend that Apple Music has reached 10 million subscribers. This trails what The Verge estimates is over 25 million Spotify subscribers, but represents impressive growth just six months after launch. In October, Apple had a comparable subscriber base to Deezer’s 6.3 million paid listeners. It then grew an impressive 54% in the fourth quarter to become the clear global number two in subscribers. Rounding out the top five are Deezer, Pandora and Rhapsody.

Google Play Music and its sister service YouTube Red likely fall in the top 5 but Google doesn’t reveal subscription numbers. Between the acquired subscribers on Songza, Google Play Music and the new YouTube Red, it is easy to see the combined subscriber base falling somewhere between Rhapsody and Deezer.

Building an Onramp to Subscription

It is interesting to consider the different user acquisition strategies used by the leading music streaming services. Spotify has a robust ad-supported tier from which 80% of its subscribers originated. Apple Music also has and ad-supported tier at least in the U.S. It leverages the free service by embedding it inside of the subscription app, suggests an upgrade to the subscription free trial, and occasionally runs ads suggesting users listen to artists on the subscription service. However, it primarily relies on a platform advantage. Apple has sold more than one billion iOS devices and the Apple Music app is permanently affixed on the main screen. No download is required and it is always in view. Google has a similar advantage on Android.

Deezer has historically used a different strategy. It is bundled with phones as part of the service provided by telecom carriers. This has led to soft subscriber numbers. Of Deezer’s 6.3 million subscriptions, 3.3 million don’t actively use the service despite it being provided as part of the user’s telecom package according to a TechCrunch analysis. This suggests that Deezer could fall out of the top five subscription music streaming services and that bundling with telecom agreements may not yield lasting subscriber growth.

Breaking Down the Apple Numbers

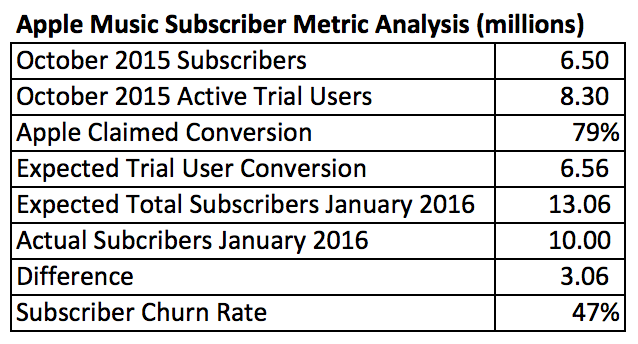

A key question in October when Apple announced its initial subscriber numbers was whether the users planned to pay the monthly fee to continue using the service or if they had simply forgotten to cancel the trial. Those cancellations would result in what the industry refers to as churn – the rate at which existing subscribers depart the service. Today’s numbers may shed some light on that question.

In October 2015, Apple revealed that it had 6.5 million subscribers and 8.3 million users still active in the 90-day trial period. Six weeks earlier Apple had vigorously contested survey results from MusicWatch that 48% of trial users has stopped using the service. An Apple spokesman said that only 21% had ceased to use the service, which would suggest a 79% retention rate.

If we let the math tell the story, a 79% retention rate suggests that the 8.3 million active trial users in October should yield about 6.56 million new subscribers about three months later (January 2016). That would have left Apple Music with a total subscriber base of 13.06 million if there was 100% user retention, alternatively expressed as 0% churn. However, the announcement was 10 million subscribers which leaves it 3.06 million short of the expected total. The difference is likely the result of customer churn. Subscribers that were on auto-renewal, which was a default setting during the free trial period, started incurring monthly fees in October. It is reasonable to assume some canceled the service because it was no longer free.

47% Churn Rate for Apple Music?

The really interesting alignment here is that 3.06 is 47% of 6.50. That is within 1% of the churn rate that MusicWatch predicted in its August survey. There are a lot of variables to contest with in this analysis. The timing of the trials that users started is one and the real meaning of the 79% retention rate is another. With that said, these are large numbers and should bring us to a reasonably consistent representation of actual results. They also closely match the MusicWatch survey data which is another data point that could increase our confidence.

The really interesting alignment here is that 3.06 is 47% of 6.50. That is within 1% of the churn rate that MusicWatch predicted in its August survey. There are a lot of variables to contest with in this analysis. The timing of the trials that users started is one and the real meaning of the 79% retention rate is another. With that said, these are large numbers and should bring us to a reasonably consistent representation of actual results. They also closely match the MusicWatch survey data which is another data point that could increase our confidence.

The implication here is that Apple Music could be facing 47% churn on the 8.3 million trial users from October which would result in about 3.9 million current users canceling their subscription in the coming months. That would leave Apple with about 6.1 million long-term subscribers plus whatever they can add to the queue from current trial users. To get back up to that 10 million subscriber mark with a sustainable base, another 7.37 million would need to be in trials today if we assume a consistent 47% churn rate. Apple has a large global subscriber base, but coming up with another 7-10 million new trial users each quarter will be a difficult task if these churn rates persist.

Expect Spotify to Show Another Leap

The current numbers suggest that Apple moved from zero subscribers to about 40% of Spotify’s paying user base in just six months. However, a Spotify executive in 2015 suggested that Spotify’s subscriber base was growing faster in the second half of the year than the first half. That would place the subscriber numbers somewhere between 25 and 30 million. The company may be waiting to announce any numbers until they reach the 30 million mark.

Another rumor is that Spotify has already surpassed 100 million average monthly users including its ad-supported listening tier. The second largest monthly listener total is Pandora at about 80 million. It is expected to launch an on-demand subscription service in 2016 based on the recently acquired Rdio technology. It is reasonable to assume this launch will push Pandora subscribers past Deezer and likely rival Apple Music for the number two spot.

Subscribers Are the Small Part of the Market

Regardless of what happens with subscriptions, Nielsen and Strategy Analytics data show that between 89-95% of all streaming music users will choose ad-supported listening. As XAPPmedia CEO Pat Higbie said in a recent interview with Radio World, “There will be a lot of attention paid to subscription growth. However, each streaming service will recognize [in 2016] that the only way to win globally and build a sustainable economic model will be to optimize their ad-supported listening.”

Regardless of what happens with subscriptions, Nielsen and Strategy Analytics data show that between 89-95% of all streaming music users will choose ad-supported listening. As XAPPmedia CEO Pat Higbie said in a recent interview with Radio World, “There will be a lot of attention paid to subscription growth. However, each streaming service will recognize [in 2016] that the only way to win globally and build a sustainable economic model will be to optimize their ad-supported listening.”

YouTube, Spotify and Pandora have a big edge in audience. It will be interesting to see how Apple leverages its iOS platform and ad-supported listening option to grow its overall listener-base in 2016. However, it is clear that today access to a large non-subscriber audience is critical for building a global subscriber base for music streaming services.

Related Posts

Pat Higbie for MediaPost: Apple Music Shows Future Of Streaming Is Ad-Supported

Is Apple Music Succeeding or Failing?

Can Apple Music Shake Off the Haters? Pt. 2