Every few months a naïve journalist gets misled by a false narrative pushed by someone in the recording industry. Last winter it was the New York Times. That piece attempted to blame the decline of music industry revenue on millennials who had an insatiable appetite for “free” things that was precipitated by Napster.

Every few months a naïve journalist gets misled by a false narrative pushed by someone in the recording industry. Last winter it was the New York Times. That piece attempted to blame the decline of music industry revenue on millennials who had an insatiable appetite for “free” things that was precipitated by Napster.

A big music label couldn’t have done a better puff piece pitting greedy consumers and streaming services against starving artists, complete with video footage. It had all of the hallmarks of native advertising. Of course, the article ignored the basic facts that radio has been “free” to consumers for nearly 100 years and that music labels retain 73% of all payouts (here, and here), but apparently that didn’t fit the preferred narrative.

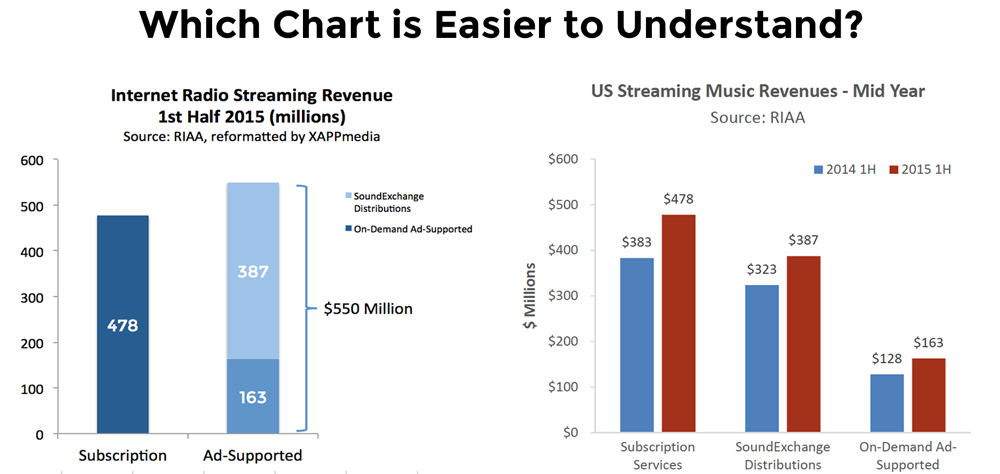

More recently, Business Insider fell into a similar trap with its headline: “The music industry has made more money in 2015 from a century old technology than ad-supported streaming.” The article reported RIAA figures that vinyl records captured U.S. revenue of $221.8 million in the first half of 2015 and ad-supported streaming only $162.7 million. Looks pretty clear until you realize it is wrong. Ad-supported Internet radio and streaming services actually delivered $550 million to music labels and recording artists during the same period. That total exceeded subscription revenue.

An Inconvenient Truth

An objective analysis of the RIAA numbers shows that 54% of all U.S. streaming music revenue was generated by ad-supported listening in the January to June period and 46% came from subscriptions. This is hard for many people to believe since there is so much focus on subscription revenue in industry media coverage and a common refrain is that it hurts artists. However, RIAA numbers show that $478 million was generated in the first six months of 2015 by subscriptions – $72 million less than advertising.

When this was pointed out in the article’s comment section, the journalist agreed that including Pandora in its reference was incorrect. It changed the examples to Spotify and YouTube. The RIAA reports revenue by distinguishing between companies that contract directly with the labels for access to content, On-demand Ad-Supported (e.g. Spotify, Slacker), and those that use standard rates set by the U.S. Copyright Royalty Board, SoundExchange Distributions (e.g. Pandora). Both categories are ad-supported and require no payment from users. The feature differences are minimal and often unnoticeable to the users. I suggest you download the mobile apps of the various services and try to distinguish the difference. From a user perspective, it is a distinction without a difference.

As a result, Business Insider updated the article to be technically correct, but misleading. This allowed them to keep the enticing title even if it was a disservice to readers. The music labels love these kinds of stories. They are waging a PR battle in an attempt to improve their negotiating position with music streaming services that contract directly and in front of the CRB, which is currently going through its quinquennial rate setting process.

Who is the RIAA Anyway?

You may recall RIAA as the group that sued nearly 30,000 Americans over the use of Napster a decade ago, including a twelve-year-old girl that was forced to pay a $2,000 settlement. Most settlements ranged from $3,000 – $11,000 with some exceeding $20,000. The Electronic Frontier Foundation reported that “a 41-year-old sugar mill worker and single mother in Minnesota” was sued for over $500,000 in penalties. At the time of the lawsuits, Napster was already shut down. There was no actual or perceived benefit from the effort other than sowing fear and intimidating consumers.

RIAA is simply a tool of its members. It can report data anyway it pleases and today music label executives prefer pushing a narrative that ad-supported, “free,” streaming music is bad. The intent of this is to improve the economics for the labels in current negotiations since they retain about 73 cents of every royalty dollar paid out. Label executives need to fund their perks and getting more from Internet radio or from unwary consumers is fair game. If RIAA’s current data presentation approach leads some in the media to misunderstand that facts, that is fine by its members as long as their preferred narrative is circulated.

RIAA Members Starve Artists of Income

The fact that these battles are about artists is pure myth. Music Business Worldwide analyzed industry data that revealed 73% of all royalty income was retained by music labels. Songwriters and publishers were paid 16%. The starving artists that music labels are so keen to help receive a paltry 11%. We don’t need to belabor this point, but it is clear that the biggest interest of the music labels is in their own well being and not for the musicians they represent. The fastest way to help “starving” artists would be to recast one-sided royalty contracts to be more fair to the creators and not solely protect the interests of the promoters.

The fact that these battles are about artists is pure myth. Music Business Worldwide analyzed industry data that revealed 73% of all royalty income was retained by music labels. Songwriters and publishers were paid 16%. The starving artists that music labels are so keen to help receive a paltry 11%. We don’t need to belabor this point, but it is clear that the biggest interest of the music labels is in their own well being and not for the musicians they represent. The fastest way to help “starving” artists would be to recast one-sided royalty contracts to be more fair to the creators and not solely protect the interests of the promoters.

IFPI Data Confirms Ad-supported Revenue’s Importance

Mark Mulligan of MIDiA Research and the Music Industry Blog recently analyzed 2014 U.S. industry data from the RIAA’s global cousin, the International Federation of the Phonographic Industry (IFPI). He found that 56% of U.S. music streaming revenue came from advertising. Interestingly, Mulligan reports that IFPI also hides Pandora revenue in another category that he had to dissect to get a full picture. There is fierce agreement across data sets on the importance of advertising revenue generated by ad-supported listening.

Reader Beware

Understanding the U.S. music industry is complicated. Some of that is the result of illegal activities from decades ago that put the industry under perpetual government oversight. Some confusion is, no doubt, impacted by the fact that broadcast radio pays no royalties to performing artists or music labels, but music streaming services do pay the majority of their revenue to these royalty owners. However, the biggest source of confusion is actually perpetuated by the industry itself. The way it presents data often seems like it is intended to confuse. An insider’s knowledge is often insufficient. Even someone like Mark Mulligan, who has written a book on the industry, must deconstruct the numbers and analyze them to answer some basic questions.

What have we learned?

- Headlines about music industry revenue are often misleading. Typically this is because of an honest misunderstanding of poorly presented data and sometimes it occurs because a music industry executive is justifying a story angle by only partially revealing relevant data or putting forward an unrepresentative anecdote. Is it their fault that people outside the industry can’t understand RIAA data? If the confusion suits their immediate business interests, so much the better for them if not for anyone else.

- Music industry executive keep 73% of royalty payments. The fight for more revenue is about generating more cash for music labels and not musicians. Broadcast radio is the only truly revenue-free consumer listening because it does not pay royalties. Internet radio and streaming music services share upwards of 70% of their revenue with royalty rights holders.

- Despite the assault on ad-supported Internet radio and music streaming services, advertising is driving a lot of music industry revenue. In the first half of 2015, it represented 54% of music streaming revenue and 18% of all industry revenue. That is only $21 million less than was generated by digital album sales during the same period.

Nielsen reports that only about 5% of consumers are paying subscriptions for ad-free music streaming. Ad-supported listening offers music labels and artists a way to generate cash from the 95% of the market that choose not to pay $120 annually to subscribe. Those listeners can always opt for broadcast radio or pirated music that generate zero industry revenue if “free” streaming listening is ever curtailed. Whatever your opinion on advertising, it is hard to dispute that it pays the bills.

Related Posts

Artists Should Blame Record Labels, Not Music Streaming

Streaming Growth is Not Undermining the Recording Industry

Nielsen Data Confirm Listener Time Shift to Ad-Supported Online Audio