The number one digital advertising topic of 2016 is shaping up to be ad-blocking. How quickly things change. Two years ago the top issue was ad fraud. Even thought the fraud problem lingered, at this time last year the hottest topic was ad viewability. The question: how much of an ad must be visible to a consumer and for what length of time before a publisher could get credit for an impression served? Should it be 50%? 100%? For one second? More? Visual display ads in streaming audio and Internet radio services had a particularly difficult challenge since about 79% of ads are served while the listening app is not visible on the smartphone screen.

The number one digital advertising topic of 2016 is shaping up to be ad-blocking. How quickly things change. Two years ago the top issue was ad fraud. Even thought the fraud problem lingered, at this time last year the hottest topic was ad viewability. The question: how much of an ad must be visible to a consumer and for what length of time before a publisher could get credit for an impression served? Should it be 50%? 100%? For one second? More? Visual display ads in streaming audio and Internet radio services had a particularly difficult challenge since about 79% of ads are served while the listening app is not visible on the smartphone screen.

However, most music streaming services rely primarily on audio ads which avoid the viewability problem altogether. If the audio is streamed, impressions are delivered. Similarly, audio ads are less likely to be victims of ad-blocking technology. This is true, in part, because streaming audio has different characteristics than visual display and because in-app blocking typically requires a VPN with customized filtering or a rooted mobile device with custom software. These approaches are not available to most consumers. Even then, most developers haven’t turned their attention to audio and its unique characteristics.

The advantage of streaming audio over other media may not persist indefinitely, but it is a notable differentiation considering that a report by Adobe and PageFair estimates ad blocking grew 41% last year. If you want an ad delivered without worrying about ad-blockers, audio is a good choice.

What the Music Industry Can Teach Everyone

When I saw the headline in Adexchanger, “What the Music Industry Can Teach The Digital Ad Industry,” I thought it might relate to the more favorable ad-blocking environment for audio ads. It didn’t. Instead, the article related to avoiding a music industry mistake. Many will recall the sad history of RIAA lawsuits against 12-year olds, unemployed single mothers, and chronically ill patients over Napster use. The effort only recovered $1.4 million from about 20,000 lawsuits that wreaked financial damage on the very consumers they hoped to coax into buying music.

When I saw the headline in Adexchanger, “What the Music Industry Can Teach The Digital Ad Industry,” I thought it might relate to the more favorable ad-blocking environment for audio ads. It didn’t. Instead, the article related to avoiding a music industry mistake. Many will recall the sad history of RIAA lawsuits against 12-year olds, unemployed single mothers, and chronically ill patients over Napster use. The effort only recovered $1.4 million from about 20,000 lawsuits that wreaked financial damage on the very consumers they hoped to coax into buying music.

The article’s author, Reid Tatoris of Are You a Human, suggests that the music industry eventually learned that removing access to digital files wasn’t the best solution. The iTunes launch created a low-friction method for consumers to pay for digital song downloads instead of accessing them for free through piracy. Music sales revenue declined in the four years preceding iTunes’ introduction so we can set aside the fact that many music executives claim the iTunes model led to the collapse of industry revenue.

Mr. Tatoris has a valid point. iTunes enabled the music industry to address the source of the problem. Consumers wanted their music available in digital form and were more interested in individual tracks than complete albums. Since the industry was not making digital song downloads available through conventional channels, consumers took the unconventional route and chose piracy until a convenient legal alternative was introduced. His thesis concludes, “Rather than trying to prevent users from blocking ads, we should focus on resolving the issues that made them block ads in the first place.”

The Different Advertising & Music Industry Models

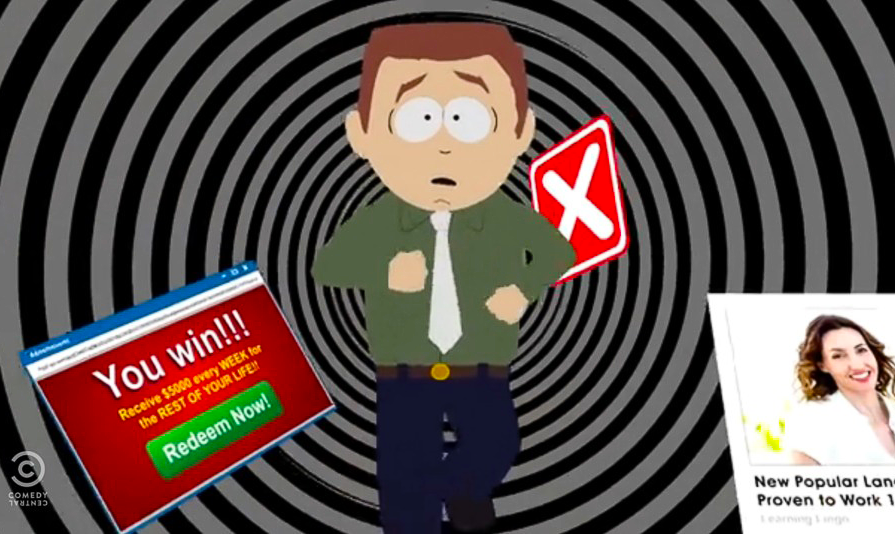

The problems that consumers are trying to address with ad-blocking include fear of malware, slow downloads, distracting ads, too many ads and privacy, among others. These are all reasonable concerns and are supported by both research studies and everyone’s personal online experience. However, change will be much harder to address than in the music industry. Many people don’t realize that a quasi-cartel of three music labels control 73% of industry revenue. That is because those three companies own the vast majority of new and catalog music titles. If the industry wants to make a change like supporting iTunes or refusing to allow streaming subscription rates lower than $120 per year, only three companies need to agree.

Advertising is different. Even though it appears that the 52% digital mobile advertising market share or 40% of global digital advertising revenue held by Google and Facebook could drive similar changes, the model is different. The problems of too many ads, annoying ad formats and malware risks are the result of decisions made by thousands of digital content publishers. Google and Facebook help deliver those ads, but ultimately don’t make the consumer experience versus monetization tradeoff decisions outside of their own content properties. They might be able to orchestrate changes by exerting their considerable influence, but there are sure to be publishers that stick with existing practices. Their presence means that consumers will continue to use ad blockers.

Audio Breaks Through an Ad-Blocker World

A Teads survey of 9,000 people reported by AdAge revealed that 41% of ad-block users installed the solutions due to pre-roll video ads. Another 88% said pop-up ads were annoying while 62% cited an excessive number of ads as a motivation and 64% wanted faster website load times. What do all of these ad formats have in common? They are all visual formats.

A Teads survey of 9,000 people reported by AdAge revealed that 41% of ad-block users installed the solutions due to pre-roll video ads. Another 88% said pop-up ads were annoying while 62% cited an excessive number of ads as a motivation and 64% wanted faster website load times. What do all of these ad formats have in common? They are all visual formats.

Since Internet radio and music streaming are predominantly delivered through apps, audio publishers are today spared the impact of browser-based ad-blockers. Even as ad-blockers make their way into the app ecosystem over time, audio ad payloads are often indistinguishable from the core music or talk content making them harder to identify and remove. If the audio ads were somehow removed, most app players would deliver dead air during the time that would be an ad, creating confusion for the user on whether the app froze. The technical hurdles for this are significant and create at least a temporary moat for audio advertising.

The advertising industry will be forced to take this situation seriously in 2016. The rising impact on revenue will demand it. A reasoned approach to addressing the underlying motivations for ad-blocking use could help, but it is likely to be insufficient. In the meantime, audio advertising through Internet radio and streaming music apps will be a good method for advertisers to reach consumers.

[su_button style=”flat” size=”6″ background=”#D73C90″ radius=”0″ url=”https://go.pardot.com/emailPreference/e/35552/300″ target=”_blank”]Subscribe to XAPP Blog[/su_button]

Related Posts

RIAA Misleads While Advertising Delivers 54% of Internet Radio Revenue

Part 1: Spotify and Other Streaming Services are Saving the Music Industry

New York Times Misled by Recording Industry on Internet Radio