A report issued by the National Bureau of Economic Research last month concludes that, “interactive streaming appears to be revenue-neutral for the recorded music industry.” The summary conclusions by the report authors, Luis Aguiar and Joel Waldfogel, don’t fit the industry trends prior to the study period or the math behind the data.

A report issued by the National Bureau of Economic Research last month concludes that, “interactive streaming appears to be revenue-neutral for the recorded music industry.” The summary conclusions by the report authors, Luis Aguiar and Joel Waldfogel, don’t fit the industry trends prior to the study period or the math behind the data.

Suppose a ship is sinking at sea with 500 passengers aboard. When the U.S. Coast Guard arrives and saves all of the people, nobody views this as a “population neutral” event. They correctly view this as a rescue and report 500 lives were saved. The ship was sinking. If the Coast Guard didn’t arrive, many lives would have been lost. Likewise, Spotify and other streaming services are rescuing a music industry that was steadily sinking over fifteen years.

Music Sales Were Declining Before Streaming

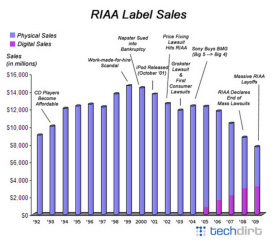

An analysis by Techdirt presents the historical pattern clearly. Between 1992 and 1999, industry revenue grew quickly from $9 billion to $14.7 billion. The chart points out that CD players began to become more affordable in 1993, which helped drive a 20% increase in label sales in 1994, followed by other sizable revenue leaps in 1998 and 1999.

An analysis by Techdirt presents the historical pattern clearly. Between 1992 and 1999, industry revenue grew quickly from $9 billion to $14.7 billion. The chart points out that CD players began to become more affordable in 1993, which helped drive a 20% increase in label sales in 1994, followed by other sizable revenue leaps in 1998 and 1999.

After 1999, a steady decline followed for many years preceding the introduction of internet radio or on-demand music streaming services. It is interesting to note that RIAA reported a decline in music sales from 2000 – 2003, but saw a bump the year after the introduction of iTunes. Then the industry experienced a sharp decline of 38% in music sales between 2004 and 2009 according to RIAA data. And this decline occurred despite the fact that during the same period, digital music sales through iTunes grew from zero to 41% of industry revenue topping $3 billion.

Subscription Music Streaming Services Start After the Decline

While Internet radio made a tepid start in June of 2005, it wasn’t until 2010-11 that streaming subscription services, such as Rdio and Spotify were introduced, in the U.S. This is when the argument arose around music streaming becoming a replacement for music ownership. The subscription services allowed users to listen to any song, anytime as if they had purchased the music. However, these services started to take hold only after a decade of declining music sales. Correlation to a pre-existing trend is definitely not causation.

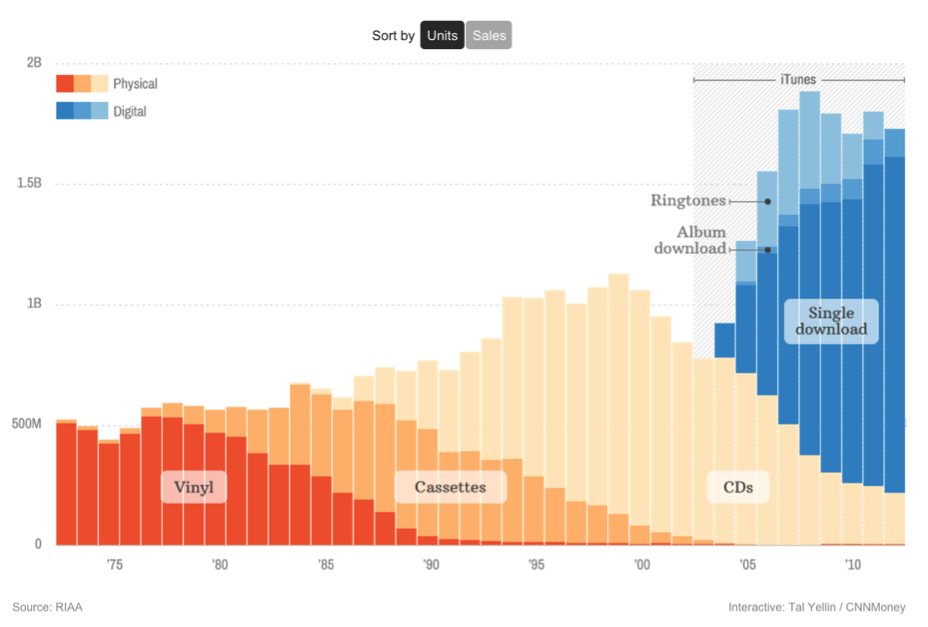

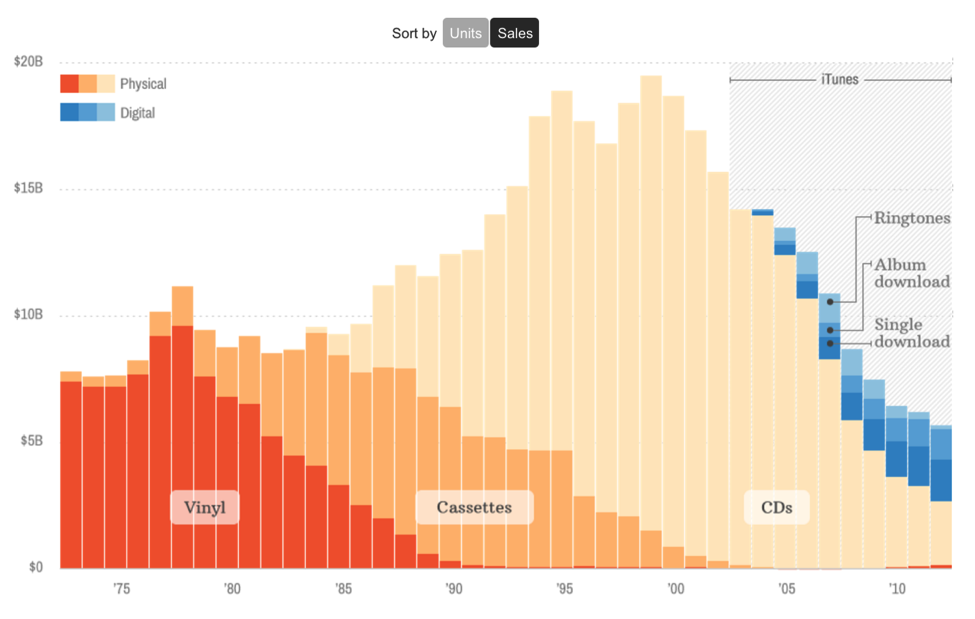

The real culprits are these pre-existing trends. By 1999 consumers had finished the transitioned their music catalogs from cassette tapes to CDs. Then, the industry released 20% fewer CDs between 1999 and 2002 according to Soundscan data cited by Lawrence Lessig in his 2004 book. There were fewer titles to purchase. Piracy also rose after the music labels sued Napster into bankruptcy in 2000 and consumers went elsewhere. The iPod was introduced in 2001 and then the iTunes store in 2003, allowing users to purchase a single track instead of a full album. This meant consumers could individually purchase their favorite songs for about a dollar instead of forking over $10 – $15 for an entire album filled with songs that didn’t interest them.

It is widely acknowledged that the iTunes model accelerated the downward revenue trend and cannibalized industry revenue. CNN Money in a 2013 article put it succinctly:

“After Apple’s iTunes Music Store debuted on April 28, 2003, sales of 99-cent digital singles surged. But that had a disastrous impact on overall music revenue…When adjusted for inflation, revenue has been more than halved…During that same period, people have been buying more music than ever…Nevertheless, the iTunes Music Store’s effect on the way people buy music over the past 10 years has ensured that the music industry will never again be the same.”

These facts were well understood until the music labels decided to conjure another hobgoblin to blame for their stewardship during the iTunes era. Streaming music was taking off and industry revenue was still not growing in the U.S. This latest scapegoating ploy is just another attempt to assert leverage over the industry and constrain consumer choice. The data show that streaming revenue is keeping the industry afloat, despite claims to the contrary.

Streaming Closes Music Industry Revenue Gap

RIAA data on the first half of 2015 show that streaming music now accounts for nearly one third of industry revenue. We can draw a correlation that streaming music services filled a large revenue gap after their introduction. RIAA sales data show industry revenue fell 38% in the five-year period of 2004-2009, and If you ignore the revenue from streaming, it would have fallen another 34% during the 2009-2014 period to $5.1 billion.

The fact is, the music industry revenue decline slowed when streaming became active in the United States. This resulted in revenue falling by only 9% in the five-year period of 2009-2014 because streaming royalties helped offset changes in consumer behavior. By the end of 2014, RIAA data show streaming services accounted for 27% of industry revenue and the growth has not abated. Streaming revenue from subscriptions and ad-supported listening accounted for over $1 billion in royalty payments in the first half of 2015.

Industry analysis that considers pre-existing trends indicates that streaming music services are revenue enhancing and not revenue-neutral as the researchers Aguiar and Waldfogel suggest. Their own data strengthens this argument further when you look at the underlying math. That is the topic of Part 2 tomorrow.

Related Posts

Artists Should Blame Record Labels, Not Music Streaming

Apple Accepts the Worst Deal in Music Streaming – thanks to Taylor Swift

Taylor Swift vs. Spotify: What Advertisers Need to Know