Data from numerous sources is delivering the same verdict: Internet radio and streaming services are mobile channels. Pandora has long claimed over 75% of listening is on mobile and it categorizes its ad revenue as 78% mobile. A recent Spotify study claims that 88% of its listeners use mobile. An executive at podcasting service Libsyn stated last year that 63% of podcasts are now on mobile, a 20% rise from 2013.

Data from numerous sources is delivering the same verdict: Internet radio and streaming services are mobile channels. Pandora has long claimed over 75% of listening is on mobile and it categorizes its ad revenue as 78% mobile. A recent Spotify study claims that 88% of its listeners use mobile. An executive at podcasting service Libsyn stated last year that 63% of podcasts are now on mobile, a 20% rise from 2013.

More strikingly, we reported in our recently released Internet Radio Trends Report 2015, that a comScore/Millennial Media study suggested 95% of all streaming audio was consumed on mobile with 79% on smartphones and the balance occurring on tablets (you can see the full analysis and charts here). While some listening still occurs on desktop, Internet-based audio consumption has migrated overwhelmingly to mobile devices. We all probably suspected this and the data increasingly supports this conclusion.

Is Mobile Shift Good for Internet Radio Economics?

Is this trend to mobile listening good for Internet radio? Yes. Many people have lamented that mobile ad rates are lower than desktop and this rapid migration of listening to mobile may impair the industry economic model. There may be some short-term merit to these arguments, but trend data suggests that mobile migration will be a great benefit to the industry.

Is this trend to mobile listening good for Internet radio? Yes. Many people have lamented that mobile ad rates are lower than desktop and this rapid migration of listening to mobile may impair the industry economic model. There may be some short-term merit to these arguments, but trend data suggests that mobile migration will be a great benefit to the industry.

Mobile ad rates are rising quickly. There is a demand aspect to this that is driven both by improved effectiveness and marketer sentiment. When mobile first arrived, it was unclear how to best advertise in the medium. The first strategy was to migrate desktop ad formats but many of them were not strong performers. However, work by the Interactive Advertising Bureau (IAB) and others identified ad formats that were optimized for mobile. The emergence of reliable performance data and new ad formats began to reduce the uncertainty of mobile as an effective ad medium.

Advertisers To Spend More on Mobile

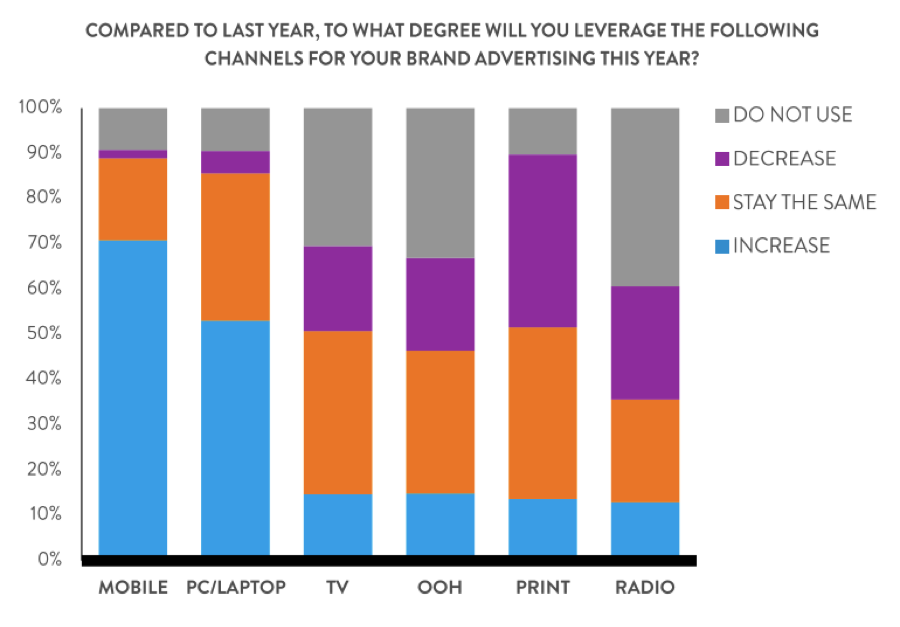

Marketer sentiment also has led to more demand. Results from a Nielsen / CMO Council survey released in December showed that 70% of marketing executives plan to increase their mobile advertising in 2015. This is after strong growth in 2014. It is a good thing that Internet radio has inven/wp-content/uploads/2015/02/brand-advertising-channels.png”>

Internet Radio Has Unique Mobile Advertising Features

Some of the challenges associated with mobile advertising in visual display do not apply to Internet radio. There is a tremendous amount of available ad inventory for mobile display and it is growing quickly with app and mobile web usage. This helps keep ad rates suppressed due to rising supply. However, Internet radio simply doesn’t have that many ad units available. Consumer usage is growing, but Internet radio services are keeping audio ad loads at or below three minutes per hour to optimize for user experience.

Additionally, Internet radio doesn’t have the fraud issues currently plaguing display advertising. The concern about bots and ad fraud are suppressing ad rates as publishers discount for false impressions. Internet radio simply doesn’t have that problem today.

BIA/Kelsey estimated that Internet radio brought in just over $2 billion in ad revenue in the U.S. in 2014. Based on listener numbers, we can assume most of that was from mobile. The market is now large and growing quickly. We think this should be a source of excitement for Internet radio publishers and viewed as an opportunity by broadcast radio stations thinking about how to grow their digital audience and establish new revenue streams. At XAPP, we are excited because recent data shows the performance of XAPP Ads is several times higher than visual display formats since they are optimized for the mobile audio environment. Sounds like good news all around.

Related Posts

Internet Radio Trends Report 2015

New Survey: Advertisers to Accelerate Internet Radio Spend

CMO’s Want ROI From Digital – What it Means for Radio