Apple announced Friday that it would be shuttering the ad-supported listening service within Apple Music. The service didn’t require a sign-up for subscription or even the free 90-day subscription trial. It was merely a continuation of the iTunes Radio service launched in the U.S. and Australia in 2013.

MacRumors summed it up this way, “Apple has quietly continued to offer ad-supported iTunes Radio stations in the United States and Australia even after the launch of Apple Music, but with the end of its current iAd platform on the horizon, the feature will be limited to those who pay for Apple Music going forward.” Is this a matter of Apple learning what business works best for music or a foreshadowing of what Apple Music subscribers will face if that service doesn’t meet expectations?

MacRumors summed it up this way, “Apple has quietly continued to offer ad-supported iTunes Radio stations in the United States and Australia even after the launch of Apple Music, but with the end of its current iAd platform on the horizon, the feature will be limited to those who pay for Apple Music going forward.” Is this a matter of Apple learning what business works best for music or a foreshadowing of what Apple Music subscribers will face if that service doesn’t meet expectations?

The Pandora Killer that Wasn’t

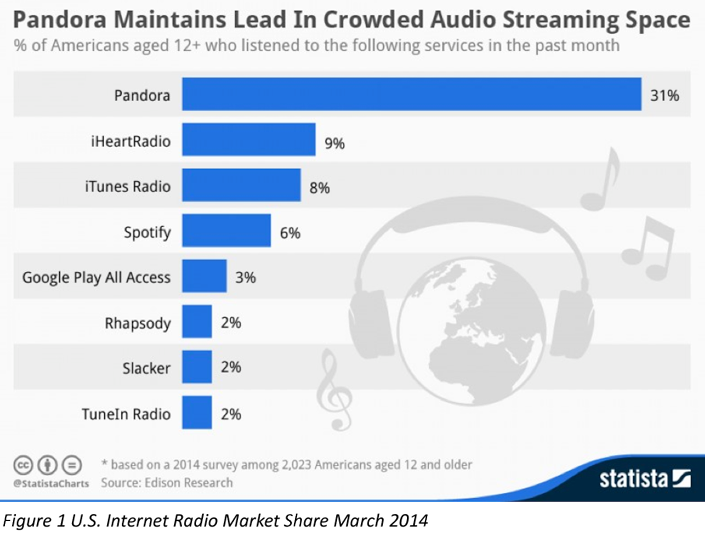

Apple’s first foray into music streaming is almost forgotten, in part, because the service was forgettable. It just didn’t have anything to make it distinct other than the Apple nameplate. The overused statement at iTunes Radio’s launch was that Apple would use the might of its iOS user base to crush Pandora. It didn’t happen. Pandora continued to grow monthly users for another year despite iTunes Radio reportedly reaching an audience of 20 million monthly listeners. That listener base placed iTunes Radio just behind iHeart Radio for the 3rd largest U.S. Internet radio audience in March 2014.

Apple’s first foray into music streaming is almost forgotten, in part, because the service was forgettable. It just didn’t have anything to make it distinct other than the Apple nameplate. The overused statement at iTunes Radio’s launch was that Apple would use the might of its iOS user base to crush Pandora. It didn’t happen. Pandora continued to grow monthly users for another year despite iTunes Radio reportedly reaching an audience of 20 million monthly listeners. That listener base placed iTunes Radio just behind iHeart Radio for the 3rd largest U.S. Internet radio audience in March 2014.

Then Apple acquired the subscription-only Beats Music and no word was mentioned about iTunes Radio again. It is a fair assumption that many of the iTunes Radio listeners were merely trying the new service and audience declined thereafter. At the same time, Apple was trying to decide what its long-term strategy would be.

Ad-Supported Service Continues into Apple Music Era

When Apple Music launched in June 2015, it seemed the company deliberately avoided mentioning the continued existence of the ad-supported service – presumably for two reasons. First, they didn’t want to distract trial listeners from the premium service subscription trial which was free and showcased on-demand features. Second, they wanted to toe the music label line that subscriptions are the only appropriate model for the industry and should take center stage in music streaming. Not wanting to alienate what iTunes Radio users remained or its advertisers, the ad-supported service persisted within the Apple Music app. We reported that on the day of Apple Music’s launch and then released an ad load report after two months of operation.

Is it a Departure from Ad-supported Everything?

The discontinuation of the iAds team seems to be the catalyst for shutting down the ad-supported listening option at this time. It is worth considering whether this decision reflects a larger truth about the future of streaming music economic models or it is uniquely related to either Apple’s strategy or inability to make its captive advertising platform work as planned.

When iAds launched in 2010, there were claims that it would capture 50% of mobile advertising revenue which indirectly suggested they were well ahead of Google. The hype didn’t turn into reality. eMarketer estimated Google’s mobile ad revenue in 2015 was 33% while Apple iAds came in at only 2.6%. In fact, iAds – which extends to all iOS apps – just barely beat out Pandora’s mobile ad marketing share of 2.4%. A recent Business Insider article suggested, “Fitting advertising within Apple has been like trying to force a square peg into a round hole.” The article goes on to relay a story from an unnamed former iAds executive, “[They] said the writing has been on the wall for some time.”

While it may be complementary to the Apple Music strategy, the discontinuation of the ad-supported listening model in the U.S. may be more of a reflection on the company’s unsuccessful foray into advertising than any specific commentary on music streaming economics. Google went the opposite direction in June 2015 when it announced that its formerly subscription-only Google Play Music would include an ad-supported, free listening tier. Executives at Google know how to make an advertising model work. They also were certainly aware that Spotify had built the fastest growing global streaming music service by offering a blend of ad-supported and subscription listening options.

What About the 95% of Listeners? They could be Yours.

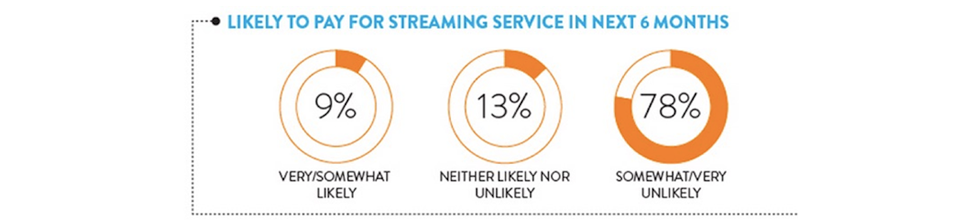

Nielsen data from 2015 indicated that 95% of consumers choose ad-supported listening when migrating online to streaming services. Earlier in the year, Strategy Analytics released a report that forecasted no more than 11% of listeners would ever choose subscription. Additional Nielsen survey data released in September 2015 seemed to corroborate this estimate when its results revealed only 9% of 3500 Americans were “very” or “somewhat likely” to subscribe to a streaming service. That result is from data taken during Apple Music’s free trial launch period which was designed to promote the highest value streaming features available to subscribers. At a time when the U.S. populace should have been at its most receptive to a subscription, 78% said they were “unlikely” or “very unlikely” to subscribe in the next six months.

Meanwhile Music Business Worldwide cites IFPI data suggesting only 0.58% of the global population subscribes to a streaming service and their analysis leads them to conclude about 2.1% of the U.S. population are subscribers. Cortney Harding, author of the book “How We Listen Now” about the streaming music industry, recently commented in a Medium post, “…paid streaming has only captured a small fraction of [listeners] – and while those subscribers now will probably continue to grow, they’ll eventually hit a ceiling. The truth is that streaming services don’t make economic sense for the vast majority of music consumers.”

Meanwhile Music Business Worldwide cites IFPI data suggesting only 0.58% of the global population subscribes to a streaming service and their analysis leads them to conclude about 2.1% of the U.S. population are subscribers. Cortney Harding, author of the book “How We Listen Now” about the streaming music industry, recently commented in a Medium post, “…paid streaming has only captured a small fraction of [listeners] – and while those subscribers now will probably continue to grow, they’ll eventually hit a ceiling. The truth is that streaming services don’t make economic sense for the vast majority of music consumers.”

Apple’s move suggests its hypothesis concludes these forecasts are simply wrong and Apple Music will be so desirable that preferences will change or that the strategy is not to aggregate a mass audience but rather focus on high-end consumers. The latter is consistent with the company’s approach across its entire product line. iTunes became a mass-market product, but since that time Apple has focused on distributing premium-priced products and eschewed opportunities to provide “value” offerings.

Since Apple is voluntarily removing itself from competing for ad-supported, “free” listening-tier consumers, Spotify is likely to have an even bigger advantage in growing both its total audience and subscription base. This also will make it easier for Pandora, Slacker and other audio publishers with ad-supported options to further grow their monthly active users. The 95% will expect to be served by someone and they are ultimately the ones that will determine whether or not an artist is successful. You can’t generate mass appeal with exposure to only a sliver of the market. Artists will quickly realize that Apple may pay relatively well on a per-stream basis, but it is less powerful than other services in promoting music, growing a career and delivering big royalty checks.

[su_button style=”flat” size=”6″ background=”#D73C90″ radius=”0″ url=”https://go.pardot.com/emailPreference/e/35552/300″ target=”_blank”]Subscribe to XAPP Blog[/su_button]

Related Posts

Apple Music at Six Months: 10 Million Subscribers and a Free Tier

Part 1: Spotify and Other Streaming Services are Saving the Music Industry

Part 2: Spotify and Other Streaming Services are Saving the Music Industry