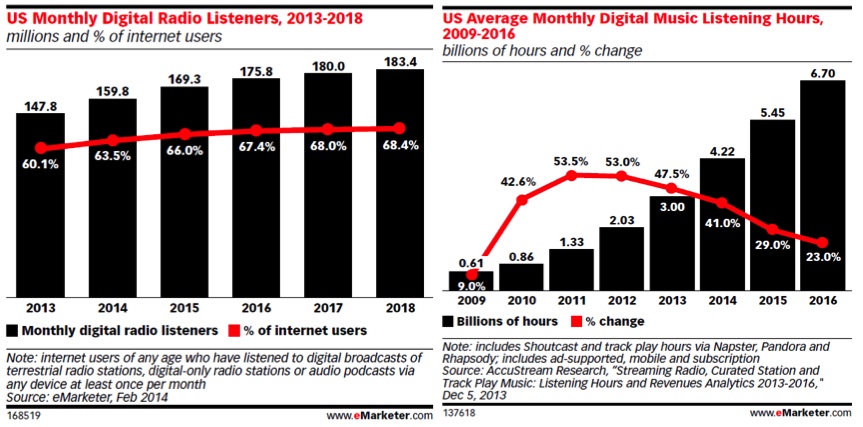

Consumers are voting with their ears. While Internet radio may have seemed like a contained novelty on desktop computers, it is an industry-changing phenomenon on mobile devices. Not only has Internet radio’s audience expanded rapidly to nearly 160 million listeners in the United States, but the monthly listening hours are growing at an even faster rate. Between 2013 and 2014, total Internet radio listeners grew by 8% while Internet radio listening hours increased 41%.

According to a Mark Ramsey Media analysis, during the 2010-13 period, radio listening fell by 13.3%. eMarketer estimates time spent listening to radio will drop another 7% in 2014 alone. Similarly, owned music sales fell by 5.7% in digital and 14.5% in CDs in 2013 alone. A study by Edison Research in the fall of 2013 concluded that 44% of time spent on Internet radio displaced time previously spent on broadcast radio and 30% displaced time from owned music. However, there is more going on here from a behavioral standpoint. These trends coincide with a larger shift away from ownership tendencies to personalized services driven by the rise in mobile devices.

These changes are creating angst among music publishers and radio broadcasters, but there are also opportunities here. Recording artists used to rely on music sales, in part, because radio plays do not pay royalties. Internet streaming services do pay royalties and have become an important new revenue source. Broadcast radio’s opportunity lies in joining the music streaming trend by putting its built-in audience and programming expertise into Internet radio apps. In part one of this series, we will consider the recording industry. Part two will reflect on options for broadcast radio.

The Shift Away from Music Ownership

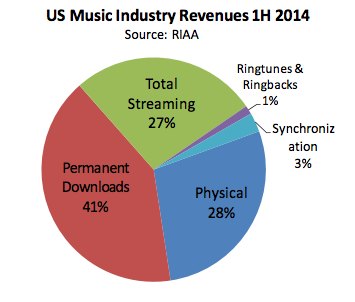

The RIAA reported in September that overall industry revenue for the first half of 2014 was about 5% lower than 2013. However, revenue from streaming services had grown by 28%. The driver of the revenue fall was less consumer affinity for music ownership. Downloaded singles and albums were off 11% and 14%, respectively and CDs fell 19%.

Many people in the music industry are lamenting this decline and blaming it on streaming services. We have recently seen Taylor Swift withdraw her music from Spotify and Garth Brooks launching a new service that will only stream music you already own. What? It is a common human trait to try and protect what you know and hold on to the familiar. However, these fierce fights to maintain a declining economic structure rarely succeed when societal behavioral changes are at work.

Societal Shifts Driving Change

The issue isn’t streaming services killing album sales. Studies show music exposure actually helps music sales. And it isn’t just radio exposure that helps sales. Famously, Daft Punk leveraged exposure on Spotify to drive music sales of its album, Random Access Memories. Add to this the fact that digital download sales have fallen in markets not served by leading streamers Spotify and Pandora, and the causation argument falls apart. Data scientists are well aware of this common mistake. Correlation in the rise of one thing doesn’t necessarily indicate causation in the fall of another.

The issue isn’t streaming services killing album sales. Studies show music exposure actually helps music sales. And it isn’t just radio exposure that helps sales. Famously, Daft Punk leveraged exposure on Spotify to drive music sales of its album, Random Access Memories. Add to this the fact that digital download sales have fallen in markets not served by leading streamers Spotify and Pandora, and the causation argument falls apart. Data scientists are well aware of this common mistake. Correlation in the rise of one thing doesn’t necessarily indicate causation in the fall of another.

The issue with album sale declines is more likely that a core age demographic doesn’t want to own anything. It’s not just about music. Driven by a generational shift and new technology, many traditional products are moving toward a rental model. It is most obvious in the software world. How many people pay for their personal email service? How many own the software they use? How many people store their personal pictures on a rented cloud service instead of an external hard drive?

There are more people renting homes and using car-sharing services than ever before. The societal importance placed on ownership has fundamentally changed. This has auto executives very concerned. Many millennials (born 1980-1995) in the United States would rather use a combination of the Zipcar car sharing service and Uber taxi service for transportation than purchase a car.

The Atlantic in 2012 reported, “If the Millennials are not quite a post-driving and post-owning generation, they’ll almost certainly be a less-driving and less-owning generation.” A 2014 NPR report reached a similar conclusion: “It’s not just cars that millennials question owning. Nearly any possession you can think of stopped being an, ‘of course’ and became a, ‘hmmmm’ for millennials.” Internet radio skews young according to an Edison Research. This might be some solace to music publishers except that millennials represent the largest age cohort in the U.S. today at 78 million.

The proliferation of streaming internet radio services is most likely a reaction to a generation that is not interested in ownership, but is willing to rent access. In a sense, that is what radio has always been about. The key difference is that streaming services actually deliver revenue to artists and publishers.

Using Streaming to Promote Artists

The fact is that streaming produced 27% of industry revenue in the first half of 2014, according to RIAA. Music ownership likely would have fallen due to shifting societal behaviors and thankfully streaming revenues have helped fill an economic vacuum. Artists should be thinking about how they can get more value from streaming services instead of fighting them.

The fact is that streaming produced 27% of industry revenue in the first half of 2014, according to RIAA. Music ownership likely would have fallen due to shifting societal behaviors and thankfully streaming revenues have helped fill an economic vacuum. Artists should be thinking about how they can get more value from streaming services instead of fighting them.

Jonathan Dickins, who represents popular singer Adele, recently spoke favorably about the role of streaming. “Personally, I think streaming’s the future, whether people like it or not, but I don’t believe one size necessarily fits all with streaming,” he said. He talked about the different attitudes the industry has taken toward Spotify and YouTube. “Labels are trumpeting YouTube as a marketing tool: 10 million views on YouTube and it’s a marketing stroke of genius,” Dickins said. “But on the other hand they’re looking at 10 million streams on Spotify and saying that’s x amount of lost sales.”

We are seeing more examples of how the promotional benefits of streaming internet radio can have as big of an impact as broadcast radio at a lower cost. Services like Pandora, Spotify, Slacker and iHeart Radio allow nationwide reach through a single outlet, whereas in the past, promotion to thousands of radio stations was required to get the spins that would expose new artists and music to the public. This exposure can ultimately lead to more music sales, more ticket sales and more streaming revenue.

The Future of the Music Economy

Nielsen reported in 2013 that “users of on-demand music streaming services are 90% more likely than the average consumer to be heavy spenders on music.” Data is mounting that music streaming services are not the problem, but instead are the answer to music’s economic future.

Related Posts

People Don’t Watch Radio

Audio in the Car – Streaming, Voice and Interaction

Internet Radio Advertising Hits an Inflection Point